February began with pretty much every asset class rising, in some cases to record highs. But it ended on a very different note, with most markets hitting a wall. Gold, for instance, threatened $3,000/oz a couple of times but gave back over $100 in the final week.

Bitcoin entered the month near an all-time high and four weeks later was down 15%.

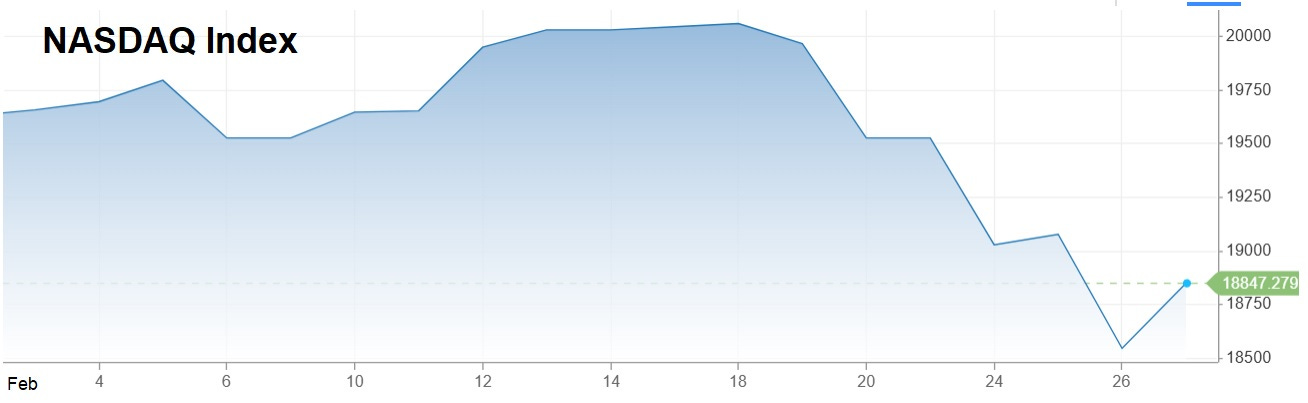

Tech stocks were near their all-time high on Feb 18, and 10% below that on the 28th.

And it wasn’t just asset prices. US 10-year interest rates fell from 4.60% on February 11 to 4.20% at month’s end.

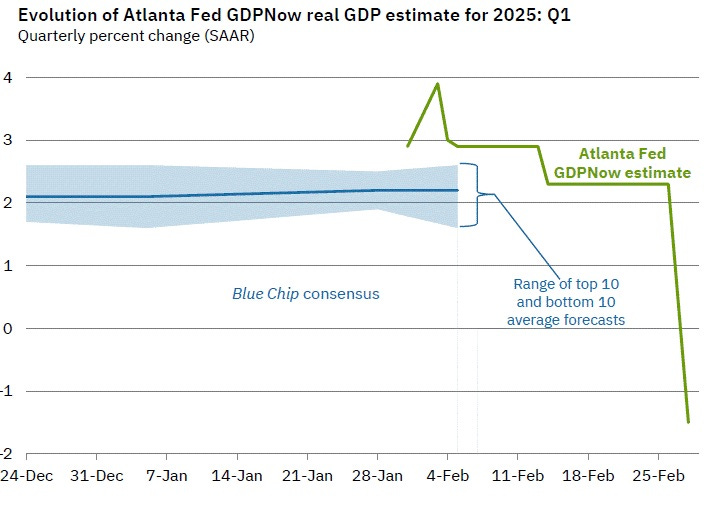

The implication? An economic slowdown may be coming. For what that means, check out the Atlanta Fed’s GDPNow measure of first quarter growth, which fell from 2.2% to -1% in the space of a single week:

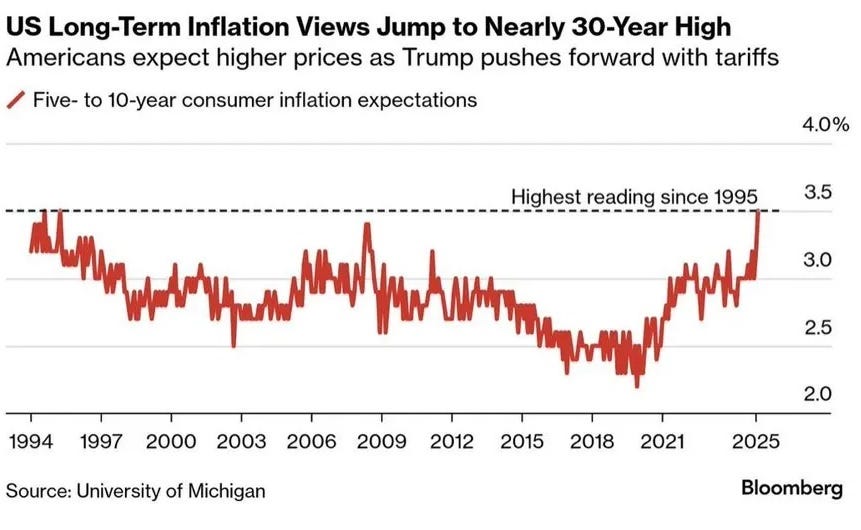

More ominous still, this broad-based slowdown occurred while inflationary expectations were spiking. Are we headed for stagflation?

See: Recession Watch: Should We Be Raising Cash?

Macro and Sector News

America’s appetite for gold is ‘sucking’ bullion out of other countries

About time… gold-backed ETF demand surges to a nearly five-year high

The Curious Case of Chinese Copper Consumption

Copper industry needs to invest $2.1 trillion over the next 25 years to meet demand

Barrick Gold signs agreement with Mali to end mining dispute

Swiss refinery, Argor-Heraeus, suspends orders for all 50-gram and 100-gram minted gold bars

Korean banks halt sales of silver bars amid soaring demand

BRICS banks bleeding gold bars: China and Russia face runaway gold demand

Treasury gold holdings worth closer to $800 billion, says Bleakly’s Peter Boockvar

The Silver Squeeze: Market Manipulation and the Coming Storm

Belgian government considers building new nuclear plants

Central banks’ insatiable appetite for gold is firmly entrenched

The small nuclear reactor revolution is underway

Just One Company Will Use 2.1 MILLION OUNCES of Silver THIS YEAR

Trump says interest rates should be lowered to go ‘hand in hand’ with his tariffs

Record Profit Margins Stand To Fuel Wave Of Gold Mining Sector M&A

US Housing Starts Plunged In January (Along With Homebuilder Confidence)

U.S. pending home sales index hits all-time low in January, gold trades down 1.43%

China’s holdings of US Treasuries falls to lowest level since 2009

Wyoming Enacts Law to Establish Strategic Gold Reserve