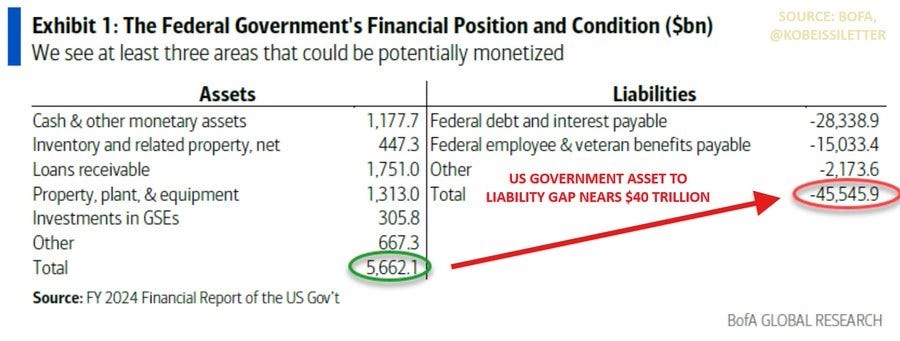

Let’s start with a look at the US government’s balance sheet. Over the past few decades, liabilities have grown exponentially faster than assets, producing a gap of around $40 trillion.

That imbalance creates extreme financial fragility — and raises the question of what might expose that fragility. Accelerating inflation is one obvious candidate, and US…