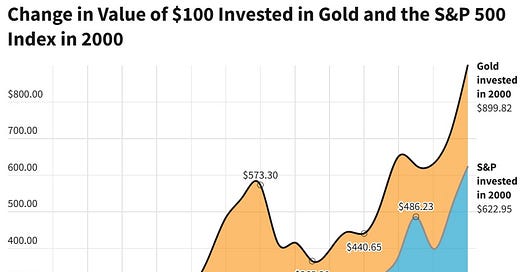

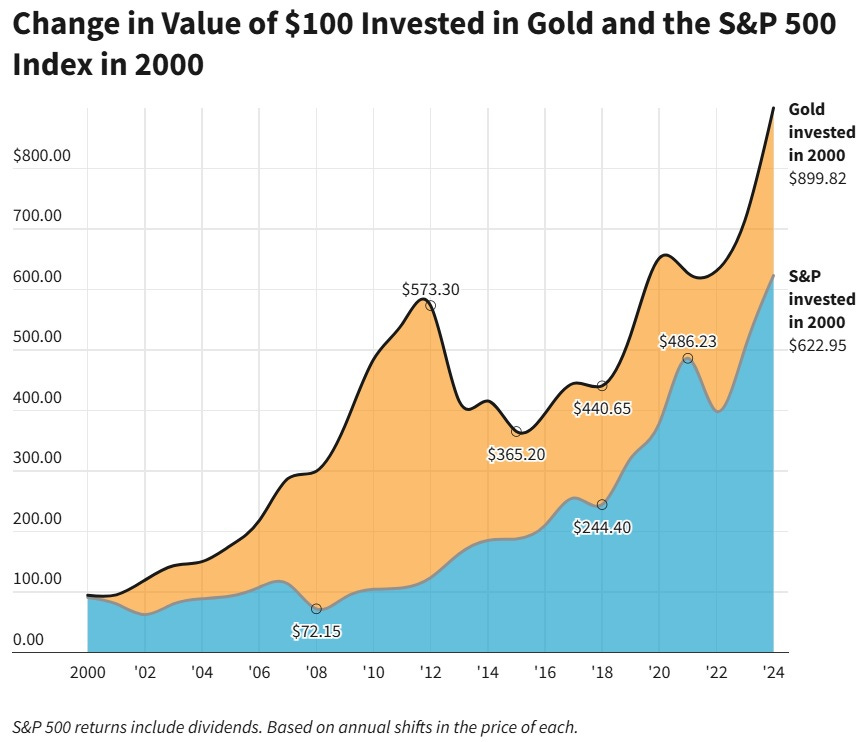

Since the start of this century, gold has outperformed stocks — despite stocks being in an epic bull market:

You’d think that gold would have gotten more attention after such an impressive run. But until recently, this has remained a largely neglected asset class.

But Now…Damn

In just the past few weeks, the news surrounding gold has gotten both strange a…