Betting against overvalued stocks can be insanely profitable — if you use put options and get the timing right. But those are big “ifs”. Here’s a cautionary tale.

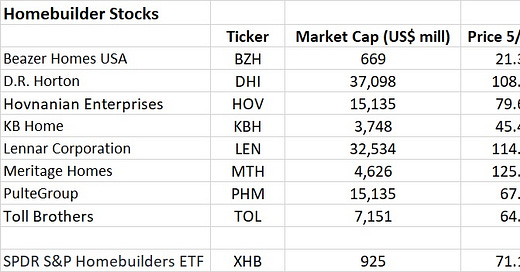

Back in May of 2023, when this newsletter was new and its recommended Portfolios needed fleshing out, I named the homebuilder stocks as excellent short candidates. Home prices were too high, m…