“There are decades where nothing happens, and then there are weeks where decades happen” — Vladimir Lenin

January was a month where decades happened. Three (among many) potential game-changers:

London runs out of gold

Huge amounts of the metal are flowing from the London Metals Exchange (LME) to US vaults. As a result, where it used to take a few days for the LME to deliver physical metal against a futures contract, it currently takes weeks.

While this was happening, gold hit a new US dollar high:

This gold migration could be due to fears about the impact of new US tariffs, which means that once those tariffs are bargained away, the gold flows will reverse and normal trading will resume. Or the recent action might signal a deeper “repatriation” trend in which countries, including the US, scramble to acquire gold in anticipation of some sort of gold standard. In that case, London’s gold isn’t coming back, and the rising price is just the beginning of a much more exciting move. Stay tuned…

China may have popped the AI bubble

The US tech stock bubble supports not just the Nasdaq but the entire global economy. And the driver of the tech bubble has been the trillions of dollars spent to turn Nvidia microprocessors into artificial intelligence data centers.

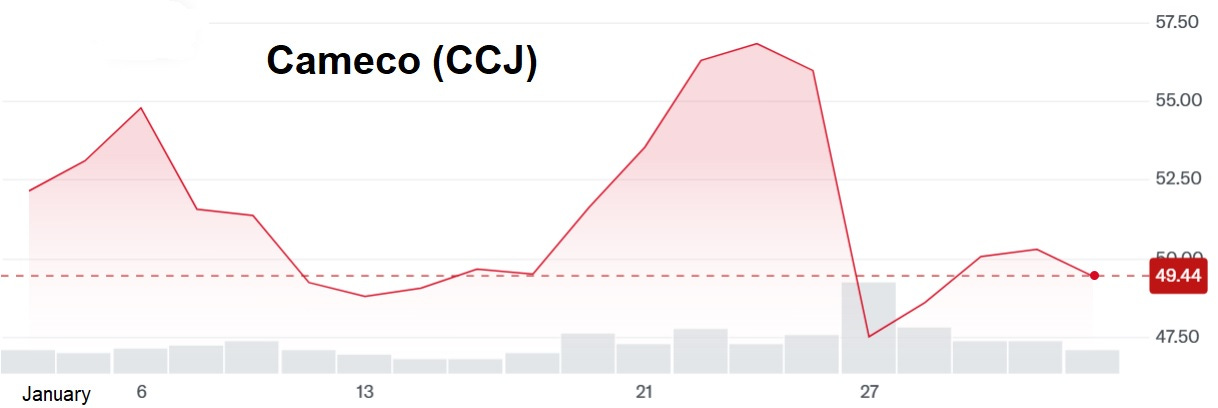

But in January, a Chinese hedge fund released DeepSeek, an open-source AI that rivals the performance of established AIs at a fraction of the cost, while running on lower-powered (i.e., cheaper) chips. Did this breakthrough just pop the tech bubble and dramatically lower future electricity demand, with all that that implies for energy commodities like uranium and copper? The markets can’t decide, with both Nvidia and bellwether uranium miner Cameco tanking on Jan 27 but stabilizing thereafter.

Again, stay tuned…

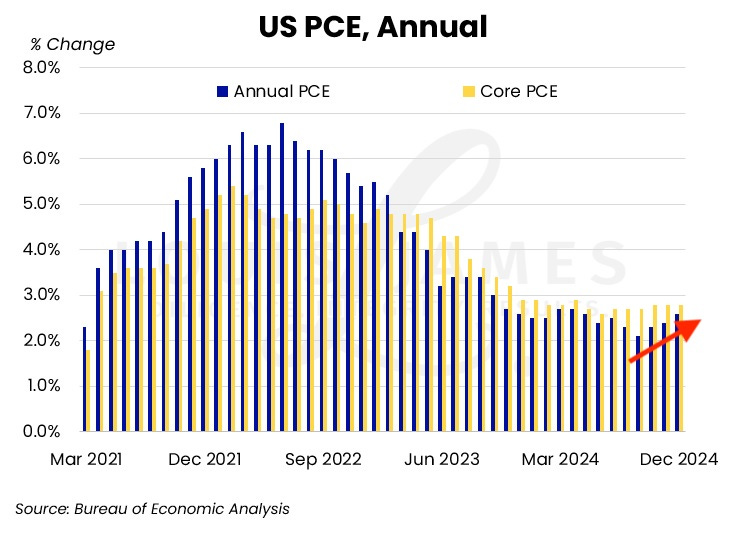

Inflation isn’t going away

At its January meeting, the Fed reaffirmed its 2% inflation target rate. Meanwhile, its favorite inflation measure is creeping back to 3%. Looks like the lower interest rates that speculators were betting on aren’t coming anytime soon. Just the opposite, in fact. Again, stay tuned…

Macro/Sector News

Gold prices above $2,800 as US core PCE rises 2.8% in the last 12 months

DeepSeek Pulls Rug Out On Nvidia, ASML

Flash Update: Why Nuclear Stocks and Uranium Stocks Got Crushed Today (January 27)

Bessent to MAGA: A weak dollar powers a boom

Trump says he’ll ‘demand that interest rates drop immediately’

UMich Inflation Expectations Soar

Rio Tinto bets Trump will give green light to US copper mine, FT reports

Trump Tariff Risks Fuel a Chaotic Hunt for Gold in London

In 21 of the 33 Metros, Home Prices Have Now Dropped Below 2022 Peaks

Massive mining sector shakeup: Bloomberg reports Rio Tinto and Glencore in preliminary deal talks

Nuclear Stocks Surged Last Year, But Are They A Buy Or A Sell In 2025?

UK faces ‘debt death spiral’ – Ray Dalio

Rising housing inventory is starting to impact sales in Florida and Texas

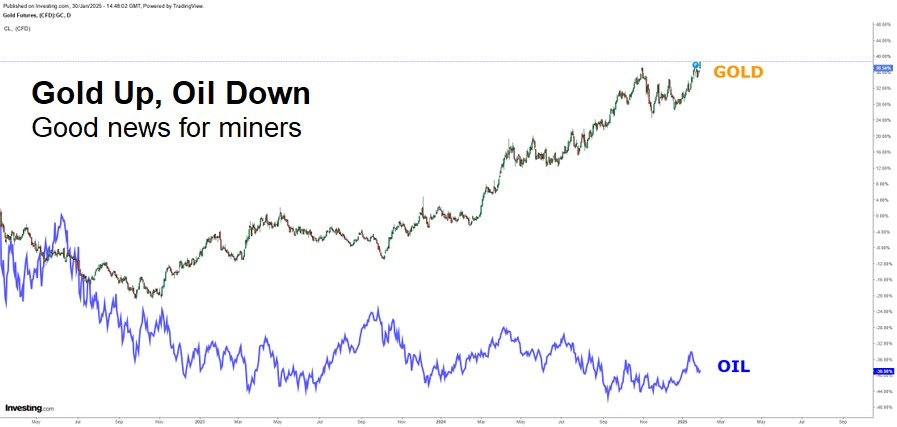

Excellent gold miner earnings are coming

Gold is up and oil is down. That means lower energy costs and higher cash flow for the best-run miners. At some point, investors will have to notice. Will the current (Q4) earnings season mark that point?