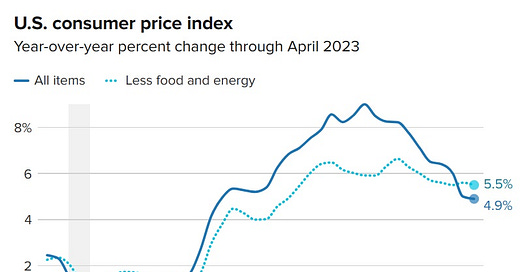

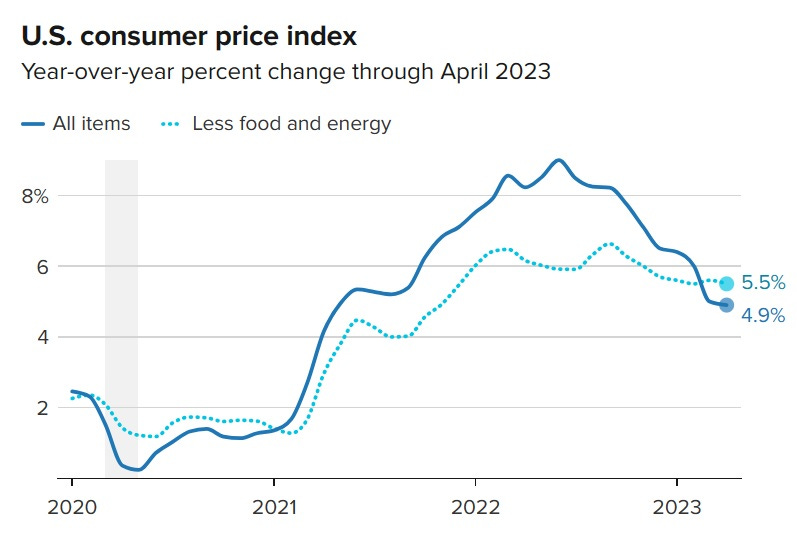

This morning’s consumer price index (CPI) print was a slightly better than expected 4.9%, raising hopes that the Fed will be able to stop tightening pretty soon.

But this speculation completely misses the point, which is that when the Fed finally does stop raising rates, monetary conditions will continue to tighten for a long time. And not just in the US, but everywhere. The world is awash in short-term debt that has to be rolled over. With interest rates now at the highest level in a decade, everything that rolls over going forward will do so at a higher rate. Which means rising interest costs — which is the general definition of monetary tightening. Governments will see their deficits rise in line with their higher interest costs and corporations will see their profits shrink, just as if the Fed was still raising rates.

Consumers, meanwhile, will keep putting their day-to-day lives on plastic. In the past year, US credit card debt has soared to a record high of nearly $1 trillion. This isn’t because an exuberant public is buying exotic vacations and hot cars. It’s because strapped families are working multiple jobs and still not covering basic expenses, and resorting to the modern equivalent of loan sharks to feed their kids. And barring a massive increase in wages, it will continue, which means monthly credit card balances charging 20%+ interest will keep rising. This is another example of monetary tightening.

The conclusion: Even if the Fed stops raising rates today, money will get tighter for at least the rest of the year, and sectors that depend on easy money will be brutalized. Commercial real estate and regional banks are obvious problem sectors, and therefore obvious short candidates at the right price. But their stocks are already down, so we’ve missed the easy part of that bet. The home builders, however, are nearing annual highs on the assumption that mortgages will be cheaper and easier to get in the year ahead. Which is highly unlikely. Adam Taggart just interviewed macro analyst Stephany Pomboy who, I think, nails it: