Watch This Undervalued Royalty Company Turn the Corner

Plus, are share buybacks as good as dividends?

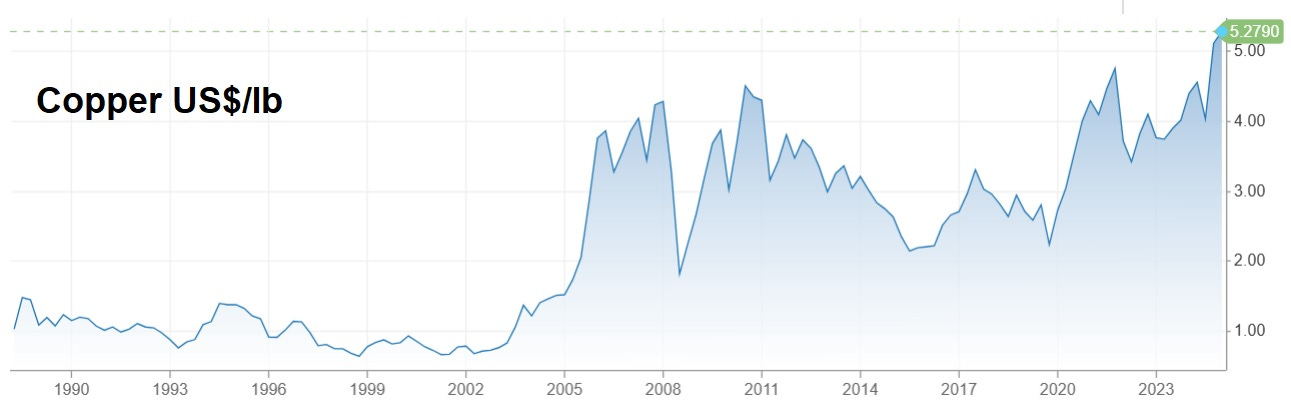

With gold and copper at new all-time highs…

…capital is migrating towards companies that own those metals. Here’s one from our Portfolio that, after languishing for years, seems to be attracting some long-overdue attention.

The backstory is that it has excessive debt and declining recent production but is in the process of paying off the former and ramping up the latter. It owns significant gold and copper royalties and, thanks to the recent price action of these metals, is likely to generate higher cash flow in Q1 (ending March 31), enabling it to accelerate its deleveraging while returning some of that cash to investors.

Its stock is finally starting to rise, indicating that investors like the near-term picture that’s coming into focus.

But before we delve into the specifics, now might be a good time to discuss the concept of share buybacks — what are they, how do they compare to dividend increases, and how do they benefit shareholders?

What are they?

A public company (i.e., one with shares of stock outstanding) can buy those shares back on the open market. They generally do this when management concludes that the stock is undervalued and buying it is, therefore, a good use of company capital.

How are they similar to dividends?

Both share buybacks and dividends fall under the category of “returning capital to shareholders” and are generally seen as positive. Dividends are direct payments to shareholders — in other words, a “bird in hand” — while share repurchases have indirect but nevertheless real benefits.

How do they help shareholders?

If a company buys back shares, the number of shares used to calculate “earnings per share” goes down, resulting in a higher EPS. This, other things being equal, makes the shares more valuable.