On the following list of 18 large gold miners, note a couple of things:

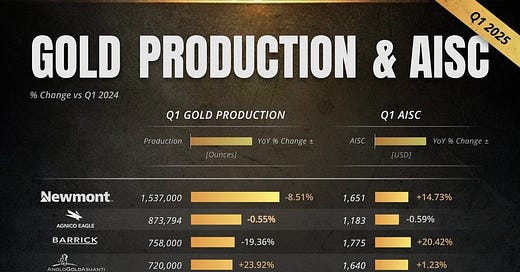

10 of them reported lower year-over-year production in Q1.

13 of them reported year-over-year increases in all-in sustaining costs (AISC).

This combination of falling production and rising costs is ominous for companies that want to grow rather than shrink going forward. But it’s being papered over by the fact that gold is soaring, thus allowing these miners to generate strong cash flow despite their operating issues.

Put another way, unless we assume a rising gold price forever, today’s excellent earnings aren’t sustainable. Declining production indicates that miners are digging up more gold than they’re discovering, while rising costs imply that new ounces are harder and more expensive to get.

So…combine copious cash flow with the above production and cost trends, and you get a lot of highly motivated executives looking for ways to prevent their companies from self-cannibalizing.

The obvious solution? Buy new, low-cost reserves from explorers and junior miners that have them. And do it quickly, before the highest quality properties are snapped up. Here’s a partial list of recent deals:

More like these are coming, and we should be investing accordingly.

Same Thing For Royalty/Streamers

Lots of big and medium-sized players in this space have royalty/streaming deals with mines that are declining. So expect most of the high-quality small and mid-tier royalty/streamers to be bought out in the next few years. Here’s a list of takeover candidates: