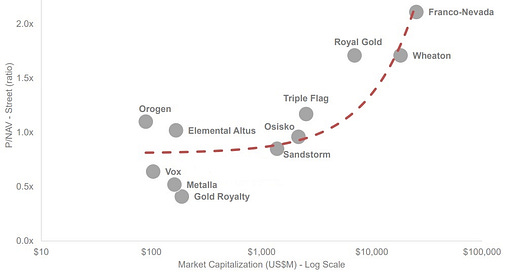

Three years ago, there were a lot more small royalty/streaming companies than there are today. The reason for this shrinkage is that emerging players in this space are basically just a bunch of royalty/streaming contracts overseen by a few (hopefully astute) analysts and dealmakers. As such they have two important characteristics: They’re easy to understand for experts in this field, and they’re generally valued at a discount to their bigger peers. The following (slightly outdated but still generally correct) chart shows that the biggest royalty/streamers’ assets are valued almost twice as richly as those of the little guys.

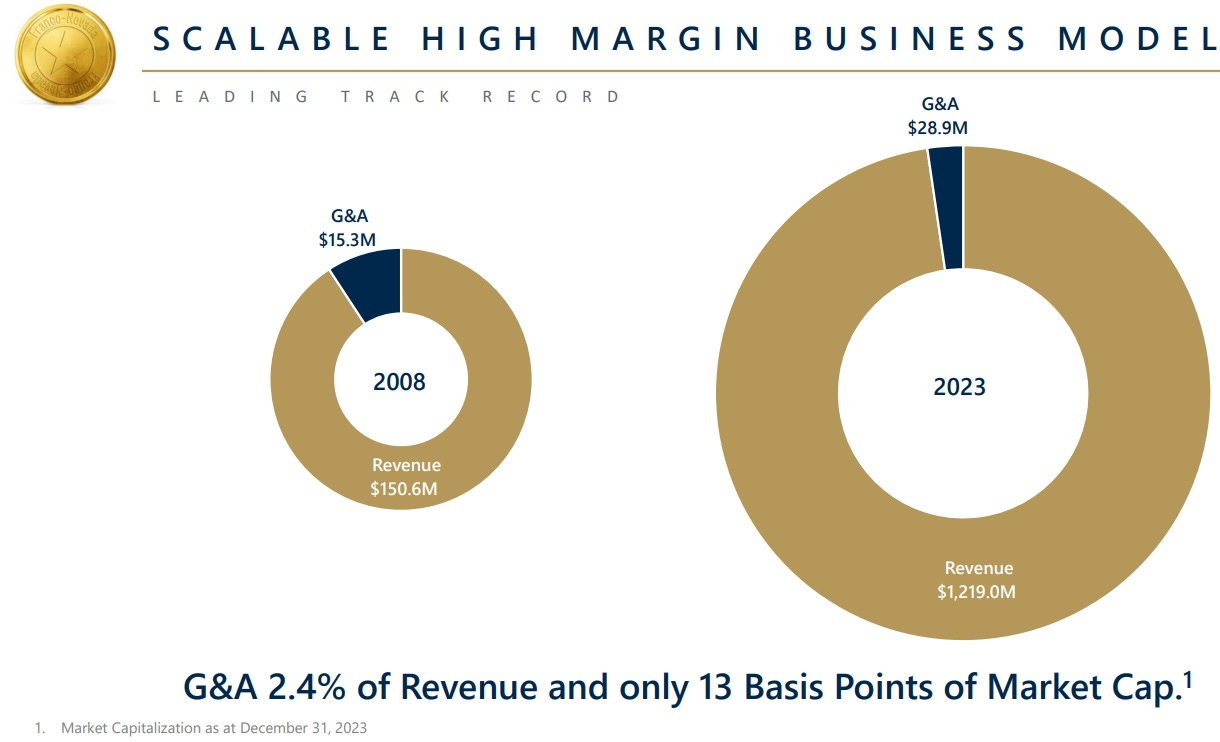

That allows the bigger players to use their richly valued stock to buy understandable, easy-to-analyze juniors and then fold the new assets into their existing portfolio without having to add more people. Here’s industry leader Franco-Nevada’s revenue compared to its G&A (i.e., personnel costs). Note that the bigger the company gets, the smaller its staff is compared to revenues.

With gold and silver in a bull market, junior and mid-tier royalty companies are. as a group, generating rising cash flow. So if they’re not acquired or merged into another junior to make a mid-tier, they’re still generally good investments.