With gold way up and silver likely (at some point) to follow, it won’t be long before big miners start competing to buy smaller ones, hopefully at nice premiums.

The pace of M&A has been accelerating for gold miners recently, and now it’s picking up for silver. Here are two examples, one pretty much like you’d expect, and another that’s surprising.

The first shows a big miner buying a compatible mid-tier:

Pan American Silver to buy smaller rival MAG for US$2.1 billion

(Bloomberg) - Pan American Silver Corp. agreed to buy smaller producer MAG Silver Corp. in a transaction valued at about US$2.1 billion, giving the bigger rival access to a major mine in Mexico.

The takeover will give Pan American control over MAG’s 44% stake in the high-grade Juanicipio mine in Mexico, a venture with operator Fresnillo Plc, as well as two undeveloped projects — Deer Trail in Utah and Larder in Canada.

Juanicipio produced 18.6 million ounces of silver in 2024, up 10% from the prior year, according to the Silver Institute. That makes it the world’s third-biggest producing mine.

The deal would bring down Pan American’s costs by about 20%, according to a presentation Monday.

MAG shareholders will receive $500 million in cash and 0.755 ordinary shares of Pan American for each stock they own, Pan American said Monday. That values MAG shares at $20.54 based on May 9 closing prices, a 21% premium.

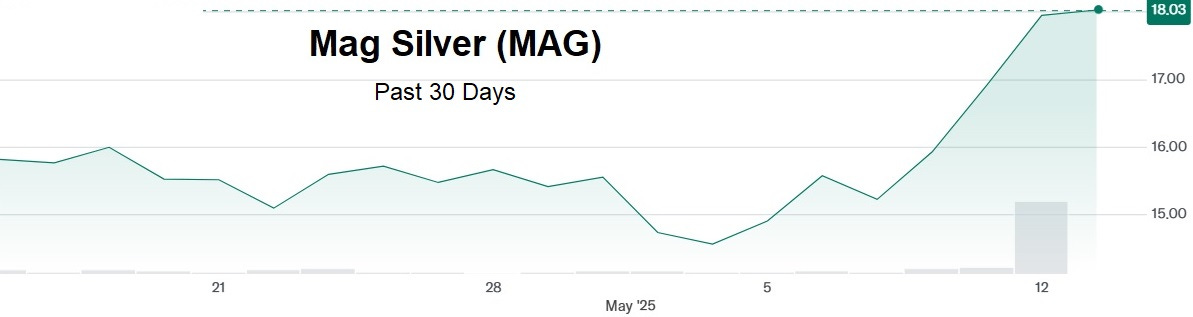

Shares of Pan American fell 14% to $23.29 as of 10:23 a.m. in New York, while MAG was up 7.4% to $18.17.

Lots more of these coming

Early in an M&A boom, big miners usually play it safe, buying smaller producers that have already proved themselves and that fit well in the big miners’ portfolios. Since the acquired company is a known quantity, the buyout premium tends to be nice but not spectacular. Mag, for instance, went for 20% above the past month’s low price.

Flipping the Script

The next deal departs from this script, with the ostensible buyout candidate (one of our Portfolio stocks) becoming the acquirer: