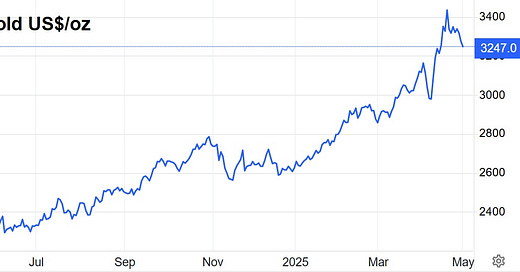

Gold had a great April, blowing through $3,000/oz on its way to $3,400. But then the long-awaited resistance emerged. As this is written, concentrated selling is taking back some of gold’s recent gains.

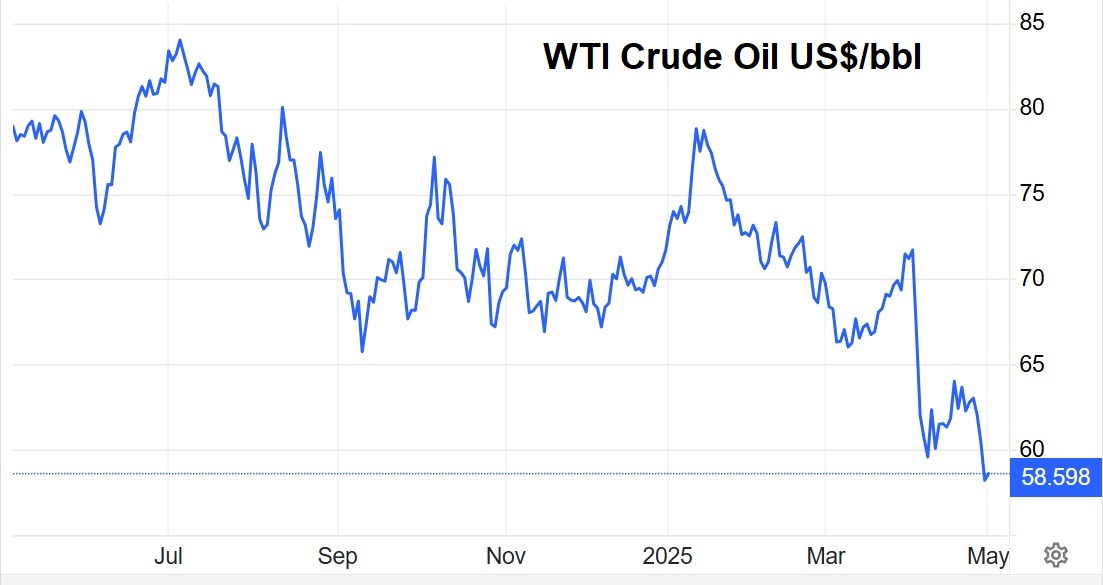

Oil, meanwhile, has had a tough month, plain and simple, thanks to the spiralling trade war’s impact on global energy demand:

The result: Gold was April’s big winner (though May could be a different story), and oil was the loser, with most other commodities treading water while global events work themselves out.

Sector and Macro News

Solar power surge fueling silver’s structural deficit and drive prices, says BMO

Late credit card payments have hit a record high

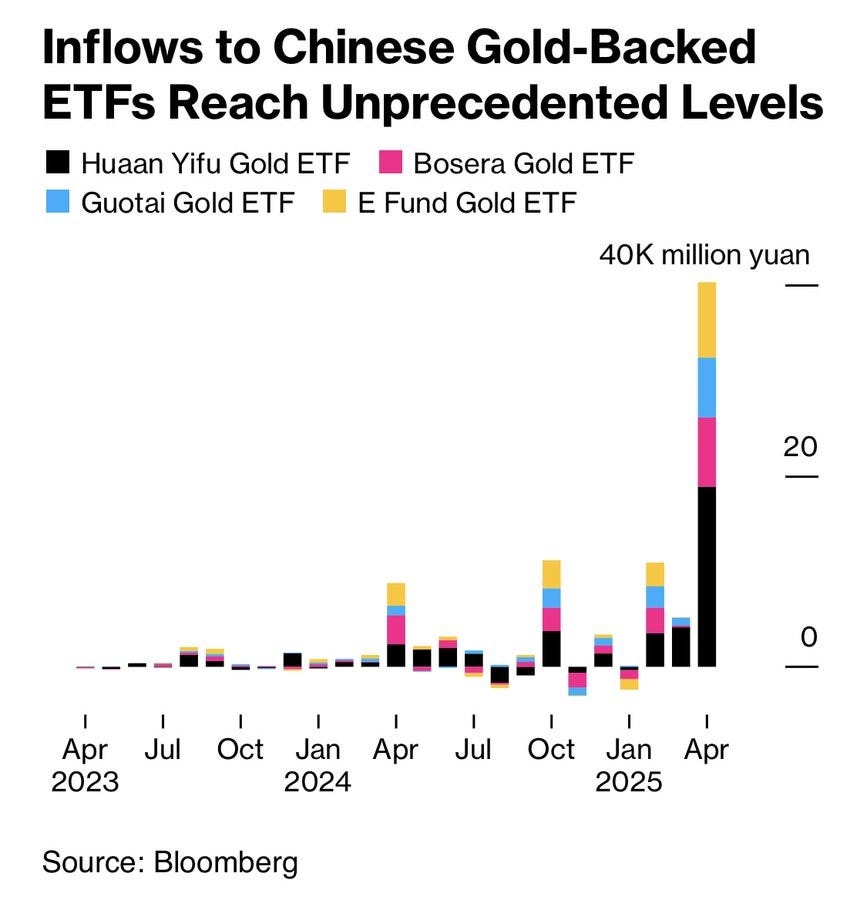

China launches major push to help Shanghai Gold Exchange compete with LME for pricing power

Ghana’s gold regulator orders foreign players to leave market

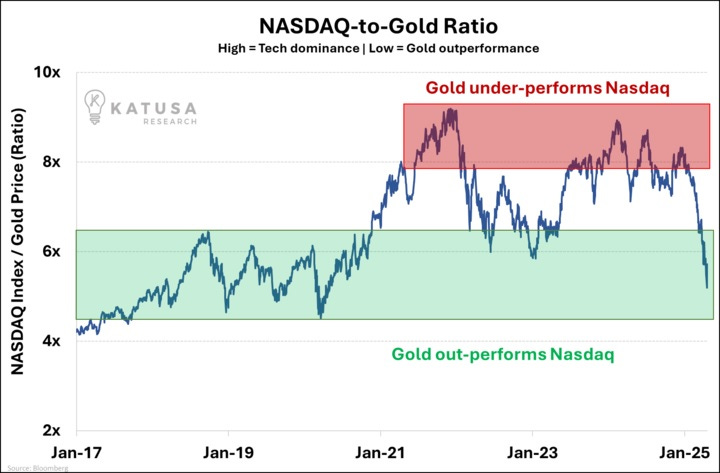

Last safe haven standing: Why is gold trading like the world is in a depression?

Agnico Eagle smashes Q1 expectations with record earnings and soaring gold prices

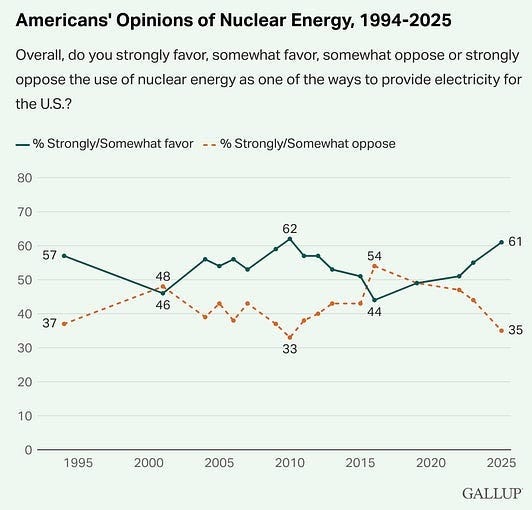

India Aims to Lure Foreign Nuclear Power Providers With Eased Liability Laws

Gold-Trading Frenzy Erupts in China as Tensions With US Escalate

Oil falls to lowest level in more than three years amid recession fears, OPEC+ production hikes

Germany Reconsiders Storing Gold in the United States

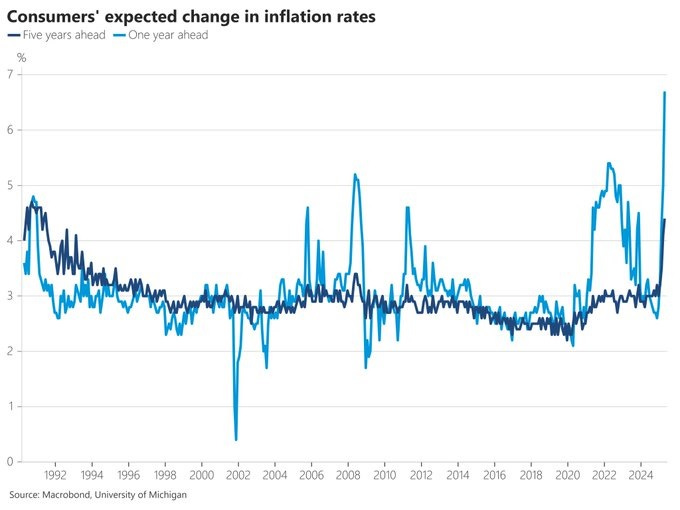

Some related charts: