Quick note: For today, I promised a post on why gold tanked post-election. But since it recovered nicely in response to today’s Fed’s rate cut, the subject doesn’t need a closer look. The gold story is unchanged — which is to say, great.

Now check out this important Portfolio stock’s Q3 earnings report:

Big One-Time Event

When companies report quarterly earnings, they compare the latest numbers to those of the previous quarter and the year-ago quarter. So when a consequential non-recurring event occurs, it impacts those sequential and year-over-year comparisons in different ways, making it hard to tell at first glance whether subsequent reports are good are bad.

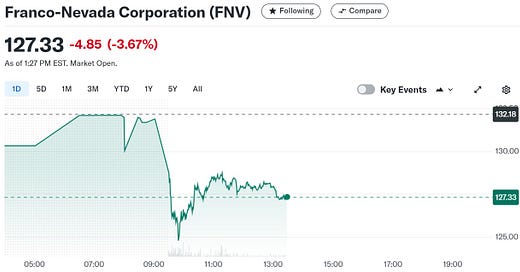

That’s the case with one of our biggest Portfolio stocks. Something serious happened almost exactly a year ago, making its just-released earnings report an analytical challenge. And — spoiler alert — the market’s initial take is negative. Here goes: