There was an “October surprise” last month, but it involved interest rates rather than politics. After the Fed announced a 50 basis point interest rate cut in September, long-term rates didn’t fall in concert. Instead, they rose for a solid month, implying that the markets no longer trust central banks to control inflation, interest rates, or anything else. This is potentially huge.

Not surprisingly, stocks didn’t like what rising rates might do to car sales, home sales, and corporate profits generally. In the final week of October, the tech-heavy (read wildly overvalued) NASDAQ index fell hard:

Precious metals followed a similar pattern, with strong October gains partially erased in the last few trading days:

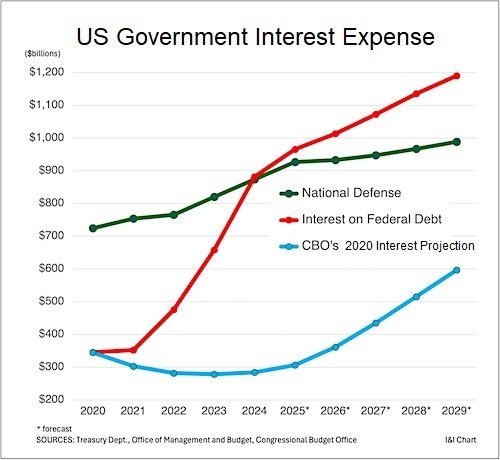

One other big thing just happened: US government interest expense exceeded the Defense budget. We have entered banana republic territory, and nothing will ever be the same.

Macro and Sector News

Major homebuilder warns of new housing problem

BRICS de-dollarization: New digital currency, gold, and Bitcoin all on the table

Silver’s secret military demand is the hidden force behind price growth

Gold-backed ETFs attracted $1.4 billion in inflows during September

Silver has no fundamental downside as the market sees deficits for the foreseeable future

Hong Kong aims to become international gold hub – Chief Executive

Russia Set to Boost Silver Reserves in Major Precious Metals Strategy Shift

Costco Gold Bars Are Selling Out Even as Prices Surge, Survey Finds

Bank backing gives US nuclear new momentum

Polish central bank increases gold reserves

Burkina Faso plans to withdraw some mining permits, junta leader says

The #Silversqueeze is real; it’s just not what you think it is

Uranium industry update (more great news)

Many silver miners will be 'ten baggers' - Lawrence Lepard sees metal at $50 oz and beyond