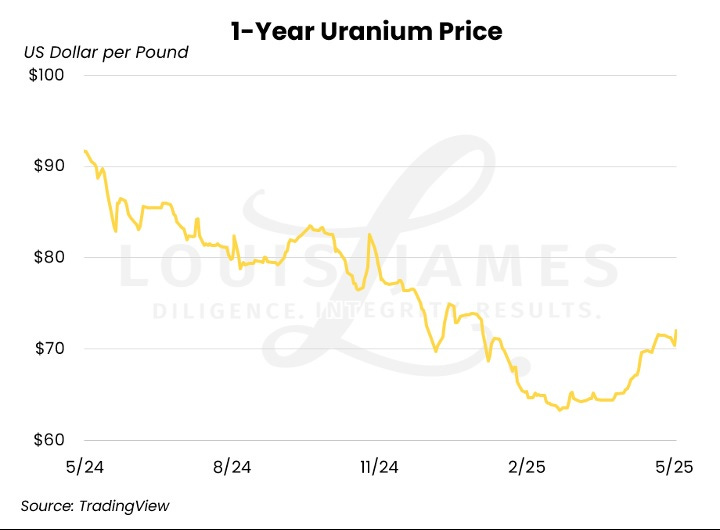

The US just ended uranium’s year-long correction by making nuclear power a national priority:

Trump Nuclear Power Update as New Order May Bring Back Cold War-Era Act

For an example of how that speeds up permitting:

US approves Utah uranium mine after two-week environmental review

Uranium’s spot price responded to the improved regulatory environment by resuming its uptrend, while uranium mining stocks popped on the news (see below).

Gold, meanwhile, held above $3,000/oz for another month, enabling the gold miners to keep generating massive free cash flow (see below).

Sector and Macro News

Is a Gold Market Shock Brewing? ECB Quietly Flags €1 Trillion in Derivatives Risk

Merz says Germany, France, U.K., and U.S. have lifted range limits for weapons sent to Ukraine

Deficits hasten fiscal death spiral

April home sales dropped to the slowest pace for that month since 2009

Germany Shifts Stance on Nuclear Power in EU Policy

Purchase limits have tightened on Costco gold bars as popularity boomed

Gold Fields to buy Gold Road in $2.4B deal

Basel III Makes It Official: Gold Is Money Again

13 workers kidnapped from a Peruvian gold mine are found dead

Q1 gold demand soars to highest since 2016: WGC

Uranium supply risk trumps demand concerns: Cameco CEO

Billionaire Ray Dalio makes a $319 million bet on gold in Q1

How to use gold and other hard assets to hedge against inflation

New Florida law recognizes gold and silver as legal tender