Well that was fun.

Gold extended its bull market into uncharted territory in March, surpassing $3,000/oz.

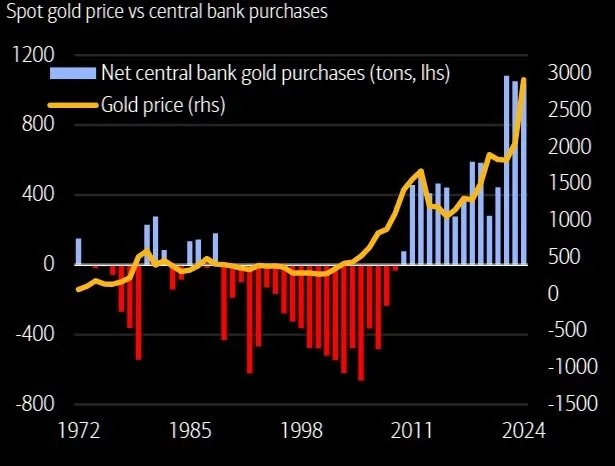

What’s driving it? Rising global chaos, obviously. But also central bank buying, which seems to be price-insensitive:

Copper had a nice run to levels that are profitable for well-run miners. All but one of our Portfolio’s copper miners are up (see below).

Silver did about as well as gold in percentage terms and generated some buzz as a “squeeze candidate.” See:

Silver Squeeze 2.0: Will silver price see the biggest technical breakout in modern market history?

Silver squeeze graphics like the following have become common:

Macro and Sector News

Silver to log fifth straight year of deficit. A look at the top-5 country producers

The Golden Age of Nuclear Energy Is Here

Copper Rises to Five-Month High After China Vows to Boost Demand

Copper is on the Verge of a Bull Market—And That’s Great News for Silver

Fed says it will slow balance sheet runoff process

"Do The Right Thing" - Trump Warns Fed To Cut Rates As Tariff Trouble Looms

Every physical silver ounce has been sold up to 1000X

Homebuyers jammed up by stubbornly high mortgage rates, tariff threats