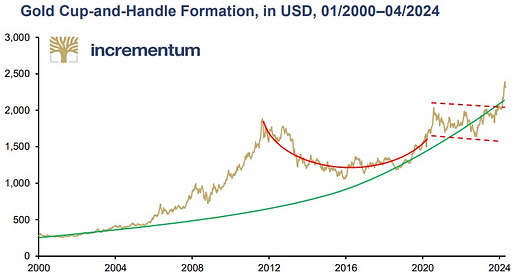

Remember that long, boring stretch where gold couldn’t break resistance at $2,000/oz? Here it is in the context of this century’s bull market — note the definitive breakout in early 2024.

What’s driving the bull market? Central bank buying. And what’s driving that? Geopolitics. Emerging market central banks started planning for a post-dollar world when t…