Okay, let’s see:

We now (as of yesterday) have a Middle East war that’s threatening to interrupt the supply of oil. And…

Deteriorating government finances.

Civil unrest and political chaos.

A revolting bond market.

Soaring gold and rising silver.

Yep, it’s official. We are back in the 1970s, which, for younger readers, was a decade of existential risks and commensurately huge opportunities.

What Happened Back Then?

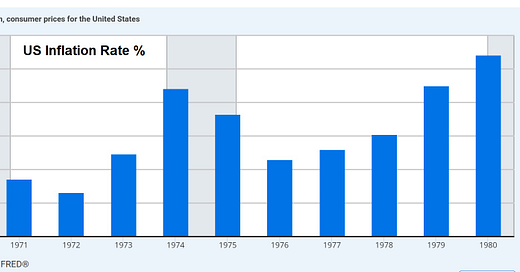

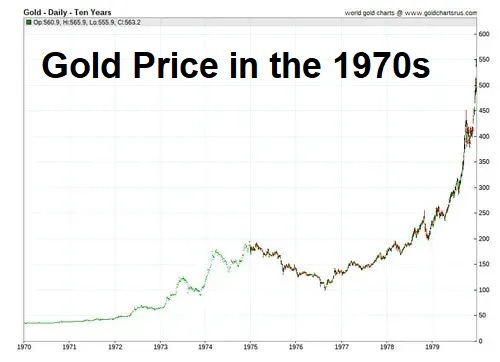

Inflation spiked:

Interest rates rose even more:

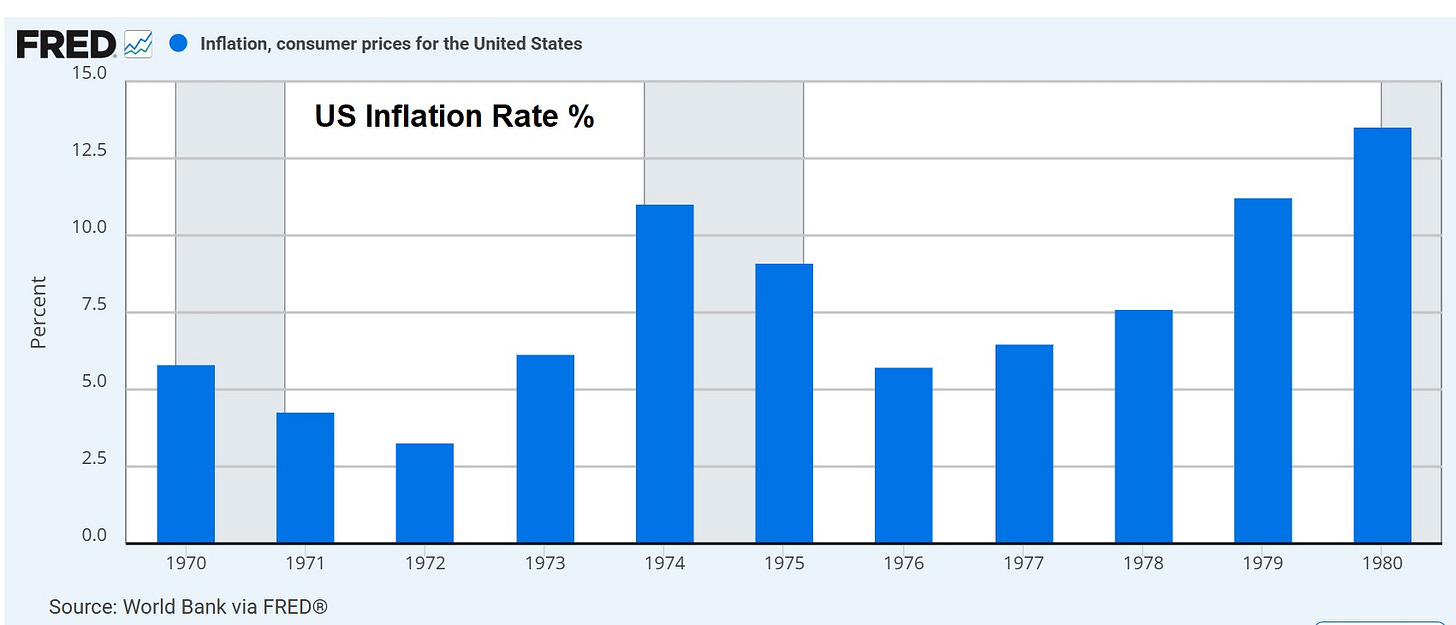

And everyone piled into precious metals, making life-changing money for a prescient few:

Where Are We Now?

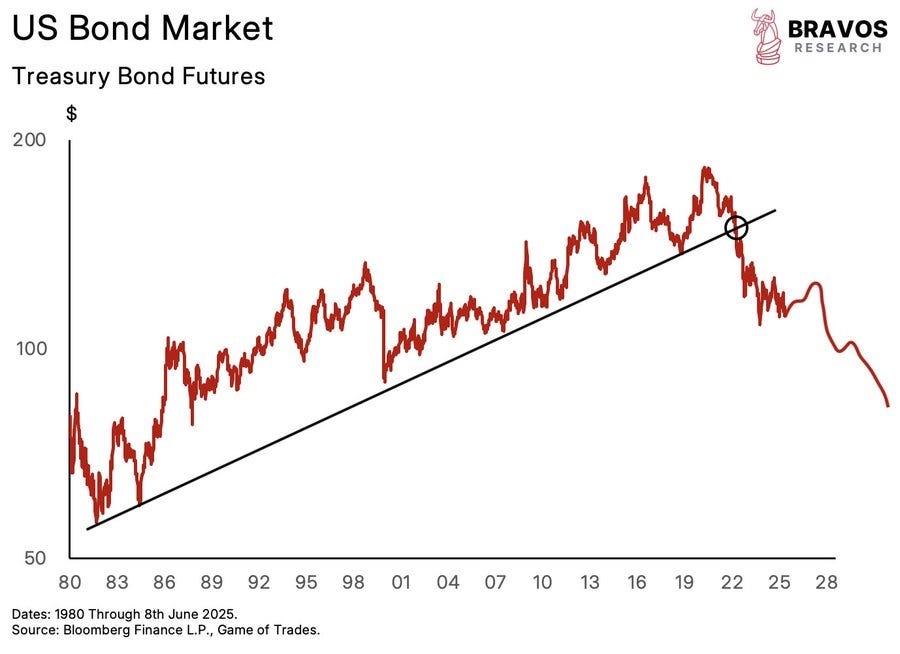

A multi-decade bond bubble (characterized by falling interest rates and rising bond prices) has burst. The past few years have been catastrophic for pension funds and retirees who bet big on Treasury bonds and similar things.

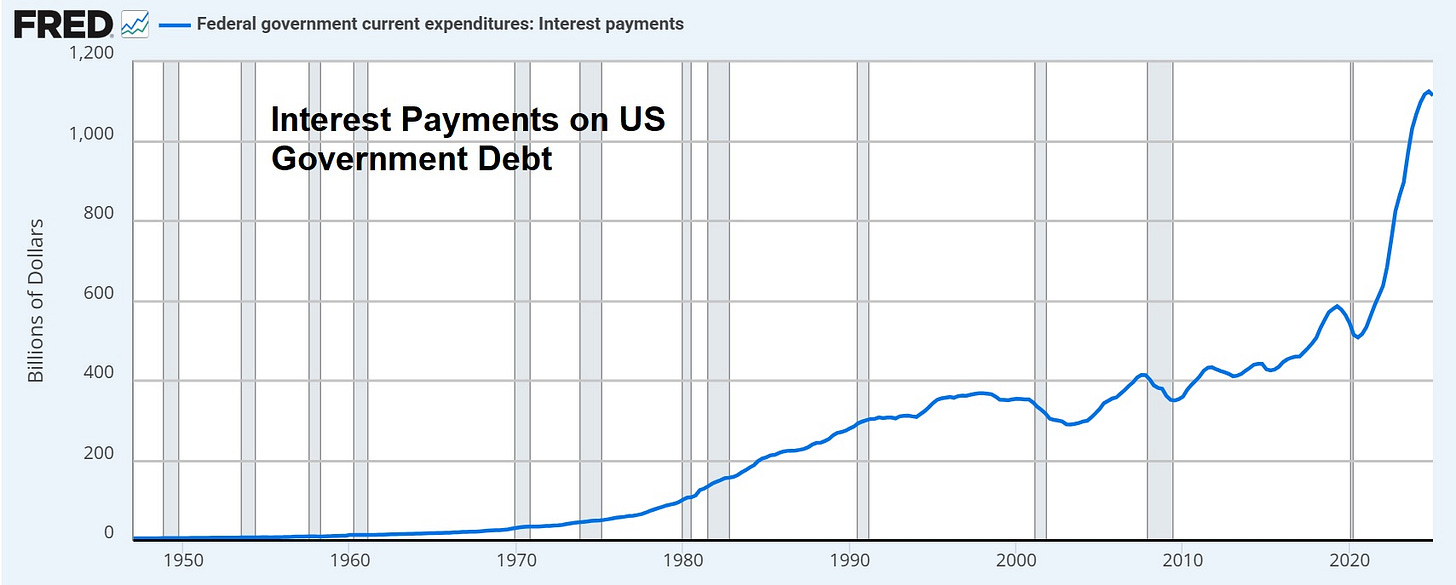

Falling bond prices mean higher bond yields, so as interest rates and government borrowing both rise, the cost of carrying US debt is spiking:

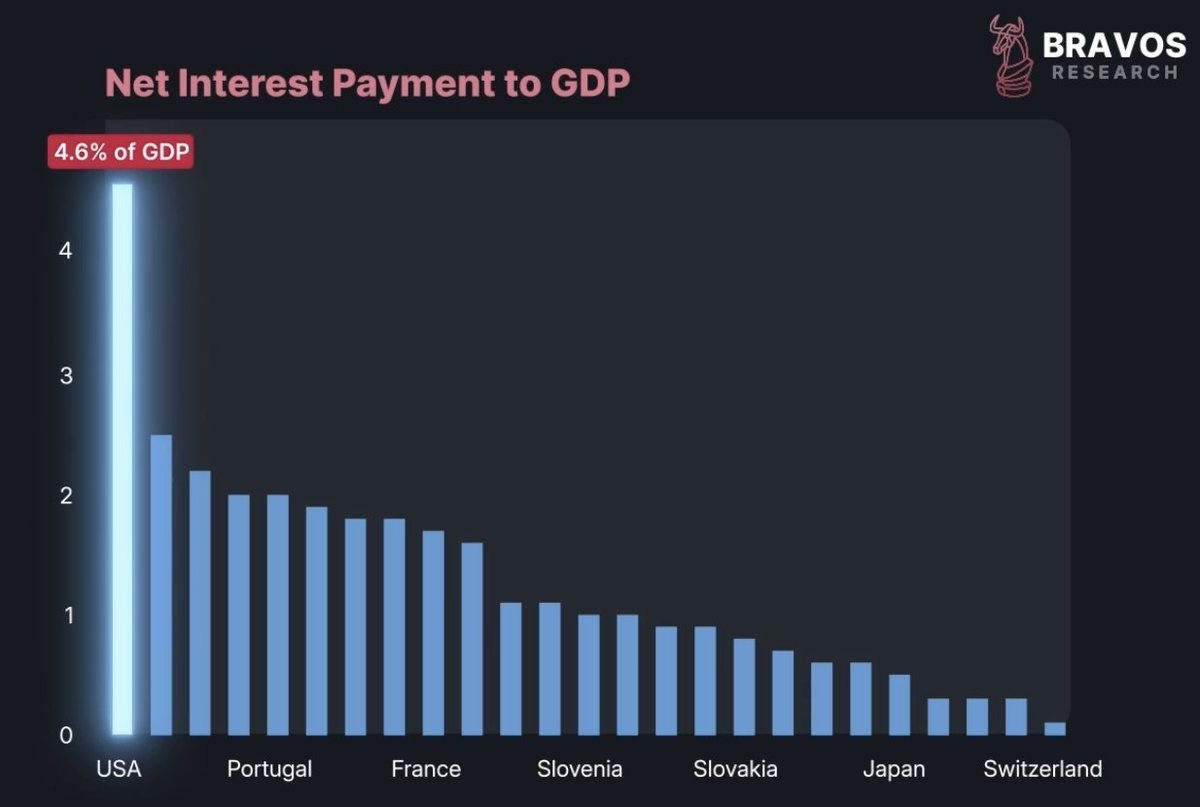

Here’s an even more ominous way of looking at this number, as a percentage of GDP compared to other countries:

Interest rates clearly need to fall to prevent government finances from spiraling out of control, and central banks around the world are moving in that direction, with the US Fed facing pressure to join the march to zero and beyond. Three related articles:

Europe’s central banks are all cutting rates, even as tariffs tie the Fed’s hands

(Politico) - Central banks in Switzerland, Sweden and — for the first time in five years — Norway have all cut their official interest rates this week, adding to similar moves last month from the European Central Bank and the Bank of England.

All five have cut their growth forecasts in recent weeks. The common theme has been that uncertainty over the trade outlook has undermined confidence and depressed activity since Trump’s “Liberation Day” tariff announcement on April 2.

Trump rips Powell, suggests appointing himself to Fed

(Hill) - President Trump ramped up his criticism of Federal Reserve Chair Jerome Powell and suggested appointing himself to the central bank.

“Maybe I should go to the Fed,” Trump mused at the White House on Wednesday, hours before the central bank was set to announce its latest interest rate move.

“Am I allowed to appoint myself at the Fed?” he continued. “I’d do a much better job than these people.”

Switzerland enters era of zero interest rates

(CNBC) - The Swiss National Bank on Thursday cut interest rates by a further 25 basis points to 0% — adding to concerns over a potential return to negative rates.

Adrian Prettejohn, Europe economist at Capital Economics, told CNBC ahead of Thursday’s interest rate decision that he expects rates to be cut to -0.25% this year, but noted that the SNB could go even lower.

“There are risks that the SNB will go further in the future if inflationary pressures don’t start to increase, and the lowest the policy rate could go is -0.75%, the rate it reached in the 2010s,” he told CNBC.

But Bond Traders Aren’t Listening

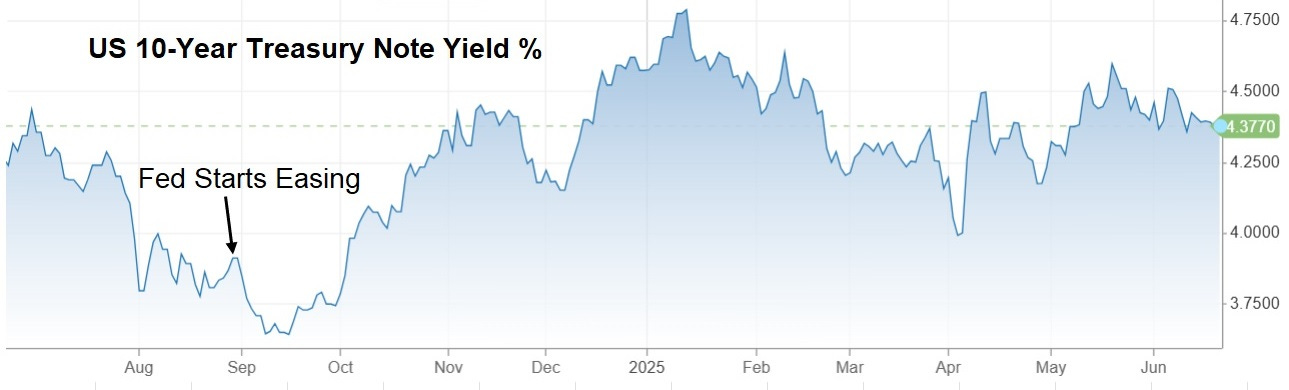

The Fed actually started easing in September of last year, but after an initial drop, US long-term interest rates rose and have stayed above 4% for most of the ensuing 10 months. No one seems to trust the Fed’s ability to control inflation.

This Time There’s No Fix

The world defeated the inflation of the 1970s with sharply positive real interest rates (that is, rates higher than inflation). They were able to do this because most major governments were in good financial shape with, by today’s standards, minimal debt and low deficits.

That’s not the case today. Double-digit interest rates would bankrupt a global constellation of debtors, bringing on another Great Depression. But aggressively cutting interest rates will spike inflation, causing currencies and related debt instruments to crash. Which leaves us with exactly zero tools capable of fixing the above problems. What’s coming, while similar in shape to the 1970s, will be vastly scarier.

So take that 1970s gold chart and add a couple of zeros. For stackers, the second half of this decade will be epic.

Unfortunately I remember it too well, as I was paying 23% on a bank loan for options that gave me a hard lesson in rolling the dice. Since then, gold, silver, uranium, and some other commodities stocks. Has been a long hard drag, but finally my ship is coming in. Sadly, as I always told my grown kids and friends, when I do exceedingly well, the country, and perhaps world, will be in crap city. I am not a seer, simply educated enough to understand economics and politics and human nature.

Unlike the 70's....

Conventional oil production peaked nearly 20 years ago, we have been desperately cannibalizing nuclear war heads to fuel reactors, and shale oil production is now declining. Renewable energy is nothing more than a mirage of hopium.

The fourth horseman of the apocalypse is now mounted - natural gas production is contracting.

Natural Resources Market Commentary - Q3 2024

Goehring & Rozencwajg Natural Resource Investors

In the volatile world of U.S. natural gas, the past quarter unfolded with all the drama of a Shakespearean act. Prices began at a modest $2.60 per Mcf, buoyed by the quiet equilibrium of early spring. But by mid-June, the plot had transformed. An unseasonal heat wave gripping the central United States sent prices soaring to $3.15, a rally that spoke as much to the market’s sensitivity as it did to the hot weather. Yet, as quickly as the heat arrived, it receded. Milder temperatures reclaimed the stage and gas prices tumbled in response, bottoming at $1.90 by the end of August.

While market participants obsessed over weather patterns, few paused to consider the silent protagonist in this unfolding drama: inventories. The 2023–2024 winter, among the warmest on record, left a legacy of near-record storage levels. At the outset of the injection season, inventories stood at a staggering 700 Bcf—or 40%— above the ten-year average. Yet, tight fundamentals have nearly erased this surplus in a remarkable turn. Over the third quarter alone, inventories were drawn down by almost 400 Bcf. By quarter’s end, storage levels stood less than 5% above the norm, a quiet but profound shift that few have fully grasped.

This brings us to the present moment, where the market stands at a crossroads. If the coming winter delivers typical cold—after two years of unseasonable warmth—U.S. natural gas prices could well align with international benchmarks which currently hover near $14/MMBtu. The implications are vast, mainly as U.S. natural gas production, once seemingly boundless, now hints of rolling over.

Over the past fifteen months, growth in U.S. gas production has stalled. Indeed, in the past seven months, production has begun to contract. Since peaking in December 2023, U.S. dry gas supply has fallen by 3 Bcf per day—a 3% decline. Year-over-year data tells a similar story, with dry gas production now down by 1.2 Bcf per day, slightly more than 1%.

More https://fasteddynz.substack.com/p/natural-gas-production-is-contracting