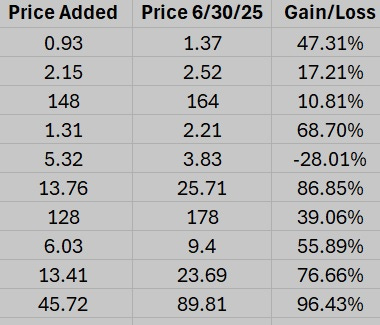

The royalty stocks are behaving like they always do in precious metals bull markets — which is to say, most are up between a little and a lot. Here are the return stats for the royalty stocks in our Portfolio:

Notice the outlier? One stock is down despite gold nearly doubling since it was recommended. That’s hugely disappointing in this environment.

The general story is that this company spent a lot of money on promising royalty/streaming deals, but was way too early. Many of its mines progressed, but not all the way to production. So revenue was inadequate and losses mounted, causing the share price to fall despite gold’s historic bull market.

Now, though, some of those too-early royalty deals are on the verge of paying off. One is going into production and may become the company’s largest source of revenue in 2026. Another just attracted a massive $1 billion investment from a sector giant, implying good things for the near future. And yet another is close to entering production on an asset with a possible 40-year lifespan.

The stock has recovered a bit on all this promising news. But it’s way below where it will be if 1) the above properties pan out, and 2) the commodities bull market persists.

The details: