For the past couple of years, the “commodities bull market” was really just gold going up. But that’s changing, as a bunch of other commodities join the party.

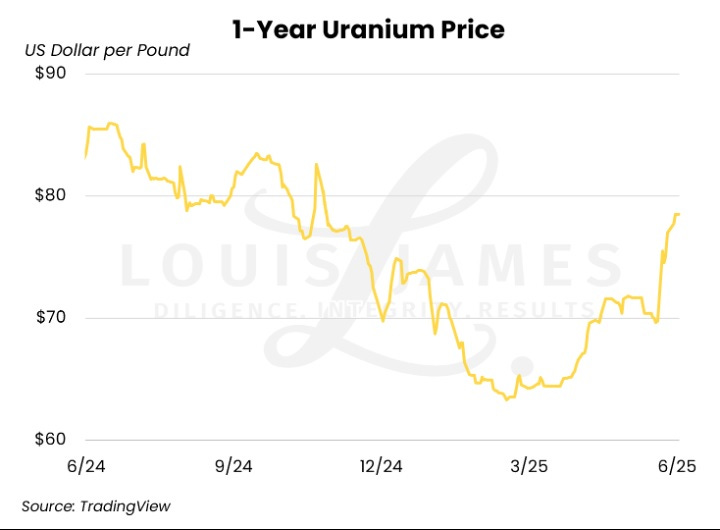

Uranium broke its year-long correction with a big upward move, driven by growing acceptance of nuclear power:

Copper made another run at its all-time high:

And platinum, the forgotten precious metal, went straight up:

For miners, higher commodity prices will produce great Q2 earnings reports in July and August. So brace for more good news.

Sector and Macro News

China to nearly double nuclear power capacity by 2040 in rapid build-up!

Dollar falls to three-year low after report Trump may name next Fed chair early

More Than a Monetary Metal: Silver's Case for Outperformance

India plans to buy 4x more uranium for nuclear energy

Return of Zero Interest Rate Policy as Swiss Central Bank Cuts Rates

Central banks favour gold over dollar for reserves, WGC survey

Support for renewables shrinks as fossil fuel interest grows

UBS Upgrades Uranium Prices On "Repowering The US" Theme Gaining Steam

The great nuclear restart goes continental

World Bank lifts ban on funding nuclear energy in boost to industry

Silver entering exponential phase

The Truth About Fort Knox and Gold Leasing

U.S. and Global Money Supply Surges to Record Highs

Oil & Gas Deals Are Tanking. The World’s Top M&A Law Firm Has Been Here Before

AEM's Lower AISC Signals Strong Cost Discipline: Can It Be Sustained?

Chain Reaction. The great nuclear restart goes continental

Dundee Precious Metals to buy Adriatic in $1.25B deal

The Condo Bust Is Here: Prices Dropped Already 10% to 23% in 20 Bigger Cities

But they do feel like selling them.

What else do people want?

Portfolio Company News

Spoiler alert: It’s almost all good.