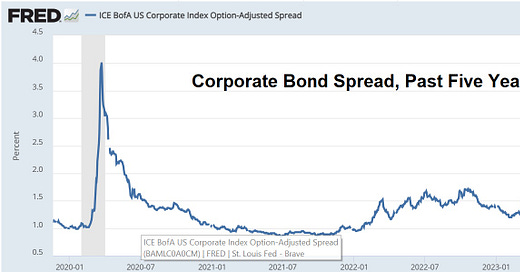

Every once in a while, the term “bond spread” pops up in financial reporting. Most people (who aren’t money nerds) don’t know what this means and how big a deal it sometimes is. So — since it’s a major red flag at the moment — this might be a good time to discuss it:

Bond spreads refer to how different kinds of bonds in a given category can have differe…