Black Swans: What If Mexico Nationalizes Silver?

Bad for some miners, great for physical silver

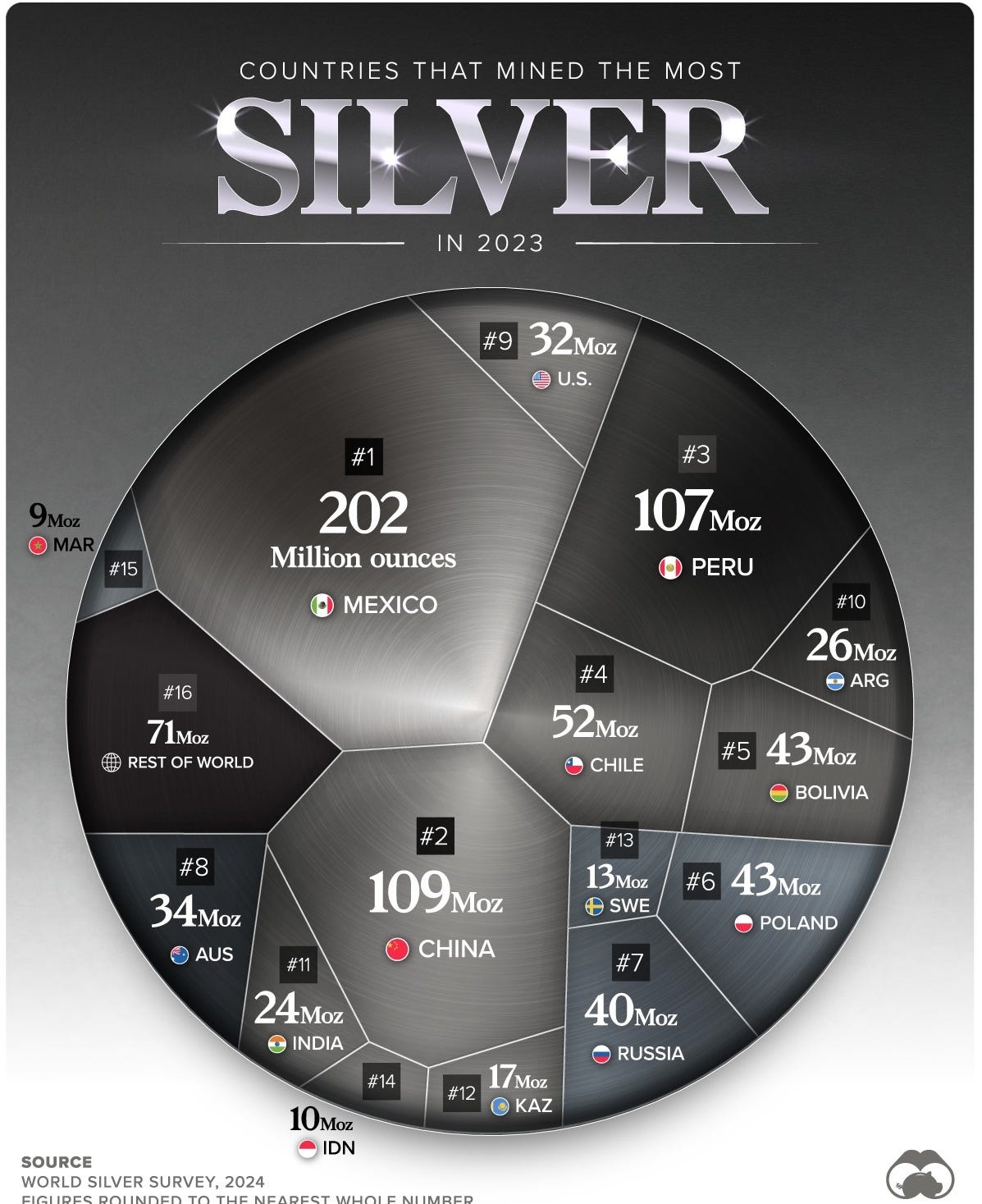

Mexico is by far the world’s biggest source of silver:

So what happens there matters to all silver investors. And things seem to be changing:

Sheinbaum maintains Mexico's freeze on new mining concessions

(BNAmeicas) - Mexico's President Claudia Sheinbaum reiterated that no new mining concessions will be granted during her administration, particularly for open-pit mining, continuing the freeze her predecessor Andrés Manuel López Obrador started in 2018.

Sheinbaum's statement comes despite the economy ministry and the private sector having signed an agreement last week that seeks to guarantee mining self-sufficiency in a geopolitical context that forces the country to strengthen its capabilities against potential rivals.

"No new concessions will be granted, that's it… There are no new mining concessions," Sheinbaum said during her Monday press conference when asked if the agreement and the halting of a legislative initiative to ban open-pit mining implied a departure from López Obrador's policy.

"So, mining is an activity with a high environmental impact. In that sense, there are no concessions, and the mines that currently exist are being reviewed for their environmental impact to determine how far extraction can continue," Sheinbaum added.

This is as ominous as it sounds, according to mining analyst Lobo Tiggre:

Political Risk Alert: Mexico (Again)

Scheinbaum is talking about curtailing existing mining, not just refusing to issue new concessions—especially for open-pit projects... And the permits? That's for necessary maintenance of existing mines, not new ones. Caveat emptor.

Meanwhile, the Silver Academy Substack has been covering this story in depth. Some recent posts:

SilverSqueeze 2.0 and Mexico's Nationalism: Once in a Lifetime Opportunity

Mexico: One Sandal Away from Nationalizing Silver

Sheinbaum Launches Bold Crusade to Reclaim Energy Sovereignty

SELL SELL SELL, if you own Silver Mining Stocks Operating in Mexico

Liquidate Your Mexican Mining Stocks Now. Resource Revolution Underway

Here’s a video from silver specialist David Morgan that explains some of the implications of Mexico’s changing policies. He’s concerned but not apocalyptic.

Yet another reason to own physical

It seems like every major resource-producing country has one or another kind of geopolitical risk these days. Will the worst-case scenario play out in every situation? Almost certainly not. But it’s impossible to predict which destructive thing will happen where.

Suffice it to say that a flat-out nationalization of Mexico’s silver resources would be a serious problem for the miners now operating there. AND it would be a potentially dramatic boost for the price of silver, as supplies became suddenly unreliable.

The solutions?

Emphasize physical metals to a greater extent than would be necessary in a world free of geopolitical risk. That means coins and bars held in accessible places, physical ETFs run by trustworthy custodians, and bullion held in dedicated storage facilities.

With mining stocks, pay extra attention to jurisdiction, and overweight exposure to the dwindling number of safe locations.

A deeper dive into which of our Portfolio’s miners depend on Mexico is coming. In the meantime, don’t avoid those stocks altogether, but do approach them with caution while that country’s mining policies evolve.

It’s very unlikely that Mexico will nationalize most or hardly any of their mines. That would kill foreign investment. The main takeaway was not issuing any new concessions. That's the same way it's been the last 4 years, but that is a far cry from selling all Mexican silver miners. Good grief!! All she said was they were reviewing the environmental impact of a few existing mines and that is also a far cry from nationalizing mines.

Those are absolutely ridiculous and quite frankly embarrassing comments from the “Silver Academy” to sell silver companies operating in Mexico, because there was NOTHING said about seizing mines from currently operating companies. This is precisely the kind of F.U.D. (Fear, Uncertainty, and Doubt) and misreading the actual news that hurts PM investors and it is sad to see it being given more air time and raising more concerns here or by Lobo Tigre (he should know better than that). Silver mining is tough enough, the last thing the sector needs is handwringing and hyperbolic statements about avoiding Mexico and selling Mexican silver stocks. People should put this so-called "Silver Academy" on ignore. They were formed by people nobody's ever heard of in 2023 and they are running click-bait titles that hurt the actual silver sector.

Please note that President Sheinbaum’s announcement does not impact operating companies or even exploration and development companies that already have their land use concessions and have good environmental studies and permits in place. If there are a few legitimate concerns about environmental issues at some old legacy mines, then those may be asked to rectify the situation or they could be closed earlier than anticipated, but Mexico is not going to "nationalize" those mines and then run them in the same environmentally sensitive ways. That makes no logical sense.

This is a big nothing burger overall that is being hyped up for sensationalism.... There already has been a ban on no new concessions for 4 years now. All Sheinbaum did he was clearly restate this fact, and her administration has already communicated a few times now that they were NOT banning open-pit mining, and weren’t nationalizing any mines, and that foreign investment capital in internationally run mining companies was safe in-country.

People need to quit reading reactionary headlines like this, do their own due diligence, and do a little deeper thinking about how it would play out economically for Mexico if they started nationalizing silver mines. They also should tune out media outlets fanning the flames of hyperbolic statements, and actually listen to the companies operating in Mexico that also put out communication all week that the media was spinning this in an disingenuous way.

Thanks for drawing attention to this important potential jurisdictional risk—it’s one to be aware of.