Lots of people envy some aspects of their grandparents’ lives, with good reason: Houses used to cost $40,000, college tuition used to be a few thousand dollars a year, and the air used to be free of plastic nanoparticles. Those really were the good old days.

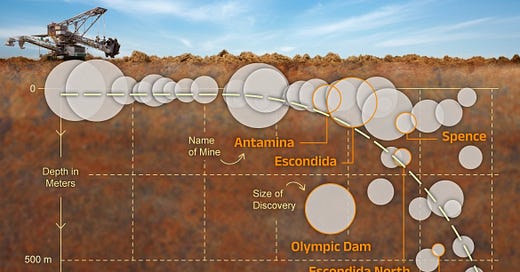

But you know who would really like to go back in time? Mining geologists who keep hearing how ea…