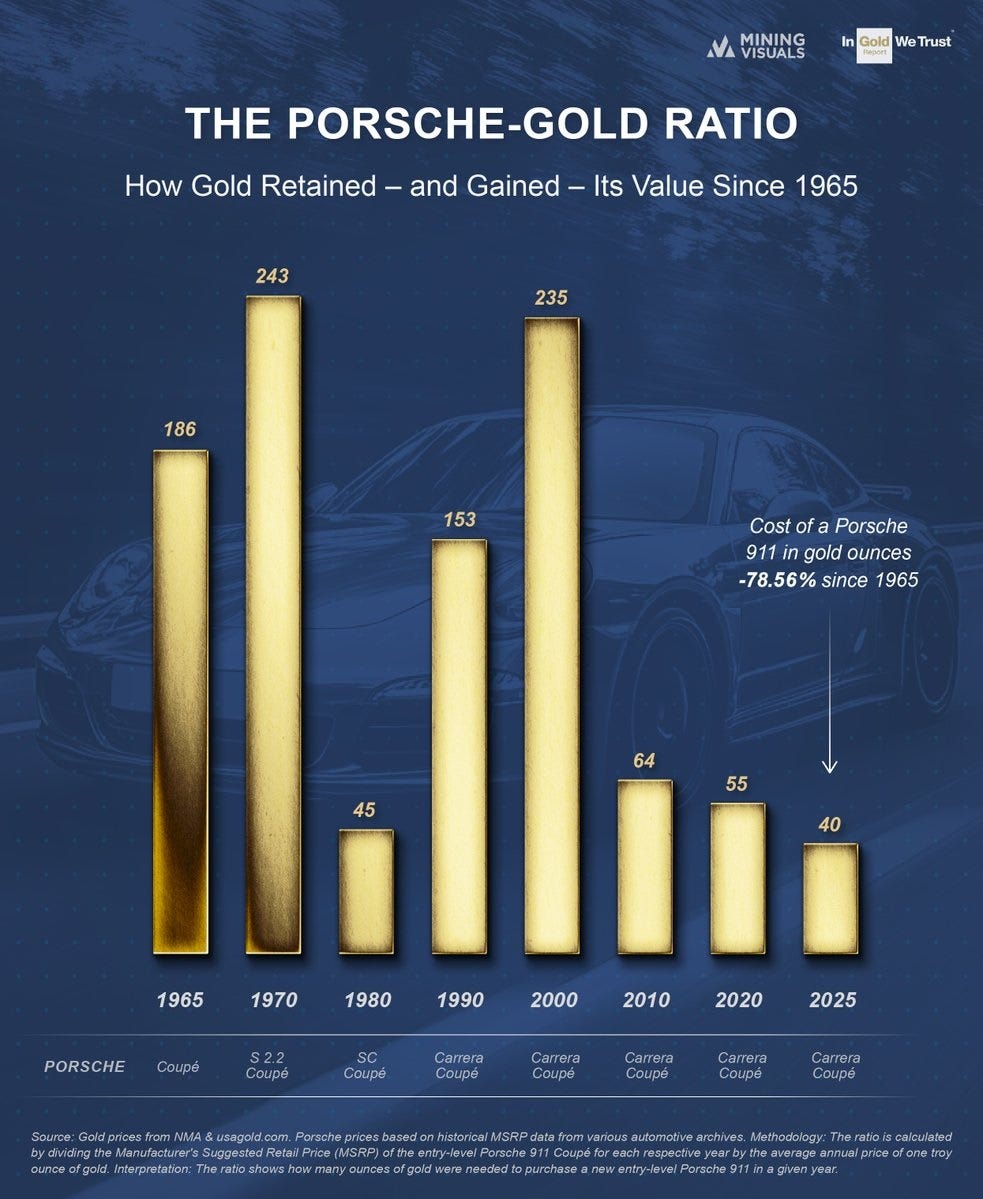

There are a lot of “xx priced in gold” charts floating around, most of which show that stocks, houses, and pretty much everything else aren’t actually going up in real (i.e., gold-adjusted) terms. They only appear to be in bull markets because we’re measuring them with declining fiat currencies.

Here’s an unusual example: The Porsche 911 sports car has seen massive deflation so far in this century when priced in gold, as the metal has risen faster than the car’s sticker price.

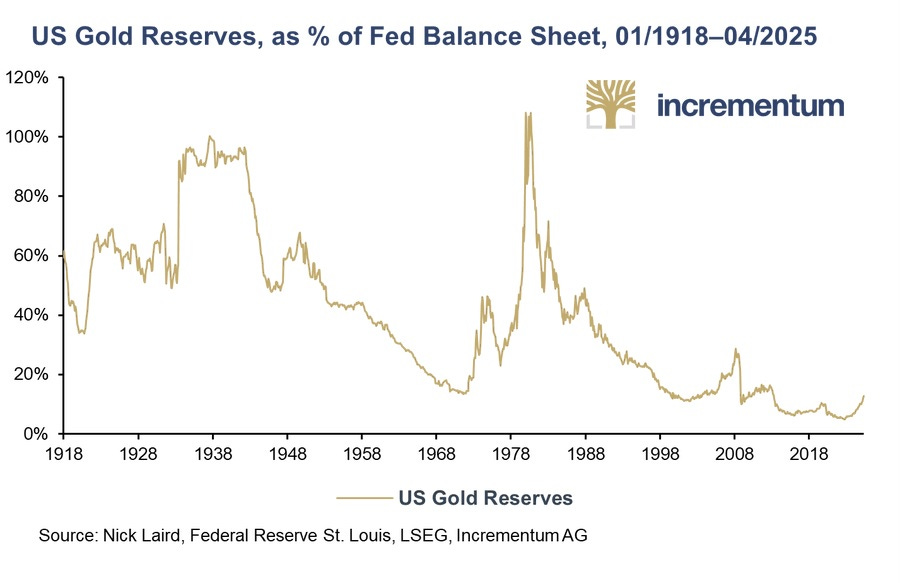

Central banks understand this. They’re accumulating gold aggressively, which accounts for a big part of gold’s rising US$ price.

And they plan to keep buying, which gives gold a nice tailwind.

This makes sense in light of the tiny share of central bank reserves that gold now comprises:

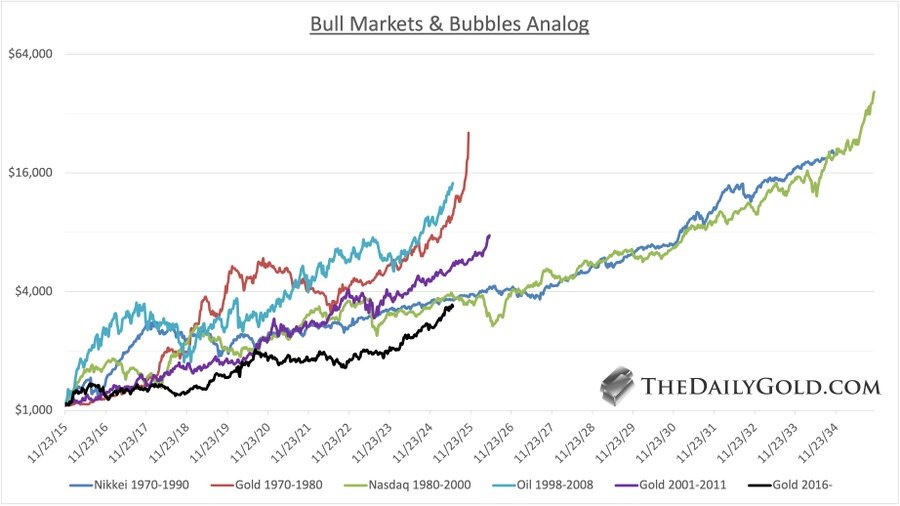

If gold’s recent rally (up $1,000/oz in the past year) feels a bit overdone, compare it to previous bull markets and relax:

Silver, of course, is another beneficiary of the shift back to real money. So keep stacking.

There's no Paul Volcker coming to save the financial system. We have reached the "inflate or die" stage of "hyper-financialization". Gold (and silver) are THE monetary measures of inflation. Ignore fedgov "statistics"/lies re increases in cost-of-living. The PM prices now tell us everything we need to know (even though silver is still subject to massive Deep State "paper" manipulation). The Fourth Turning/Long Emergency will inexorably proceed to its ordained conclusion in a massive socio-politico-economic reset. We must try to direct the course of that reset towards personal freedom/free markets rather than totalitarian control/planned economy.

John Pierpont Morgan,

A.K.A. JP Morgan said

“Gold is Money, everything else is credit”