Heading into the US presidential election, it was reasonable to expect — or rather fear — that the vote would be close. Given our chaotic state-by-state electoral system, there would be plenty of room for suspicion, leading losers to accuse winners of cheating and take to the streets. The resulting mix of lawsuits and civil unrest would create massive uncertainty about where, if anywhere, the country is headed.

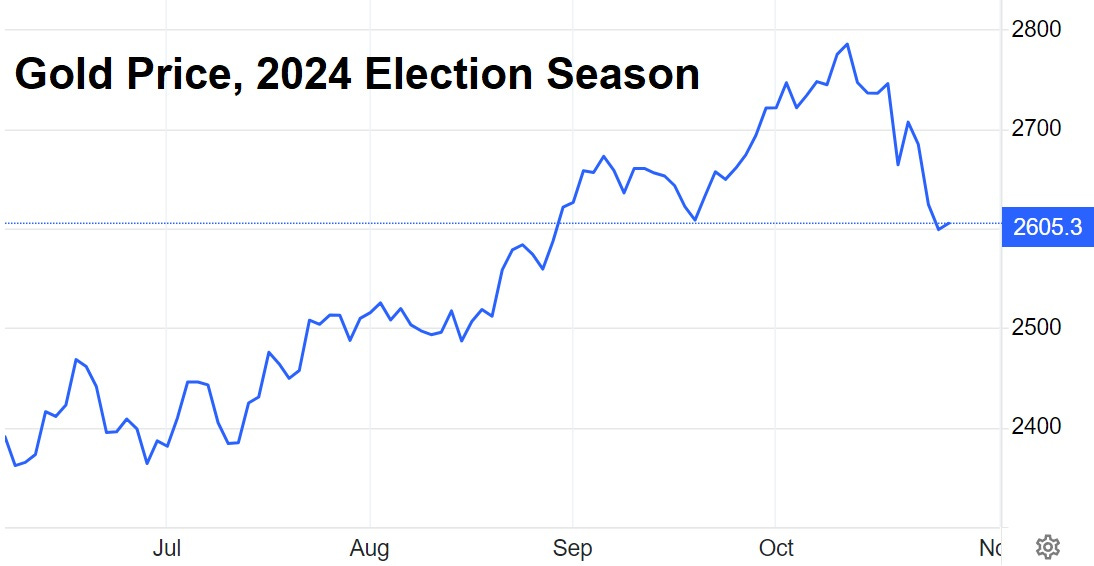

Coming after four years of open borders, multiple wars, and crippling inflation, the prospect of more chaos was chilling. And since gold is a hedge against chaos, part of the metal’s recent run-up was probably due to this looming electoral mess.

When the result turned out to be a landslide in favor of people who promised a return to stability, gold’s post-election drop was logical and reasonable.

This is Why We Use Low-Ball Bids and Dollar Cost Averaging

Bull markets don’t move in a straight, upwardly-sloping line. They bounce around in ways that seem designed to shake uncertain investors out. Here’s gold over the past five years. Note the corrections in 2021, 2022, and 2023. These happened in an overall uptrend, but at the time, they might have seemed like the end of the run.

Investors who jump in with both feet suffer immensely during the subsequent corrections, while those who seek low entry points to buy quality names and/or add a little each month over long periods find corrections to be opportunities rather than threats.

The fundamentals driving gold (massive credit creation in every major country) and silver (rising debt and soaring industrial demand) are still there. See Does There Still Have To Be A Currency Crisis? So this will probably go down as just another bull market head fake.

New Entry Points?

Let’s see what the correction did to some of our Portfolio’s highest-quality gold/silver stocks and whether they’ve suddenly become better buys.