Last week, inflation appeared to go away, as the CPI came in lower than expected and the PPI actually fell. Multiple categories of products and commodities are now seeing price declines.

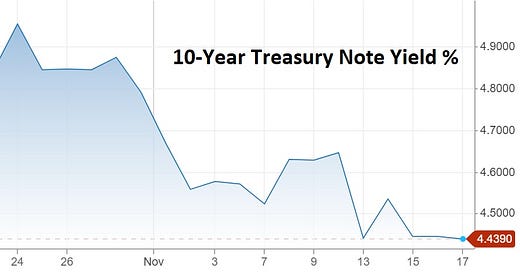

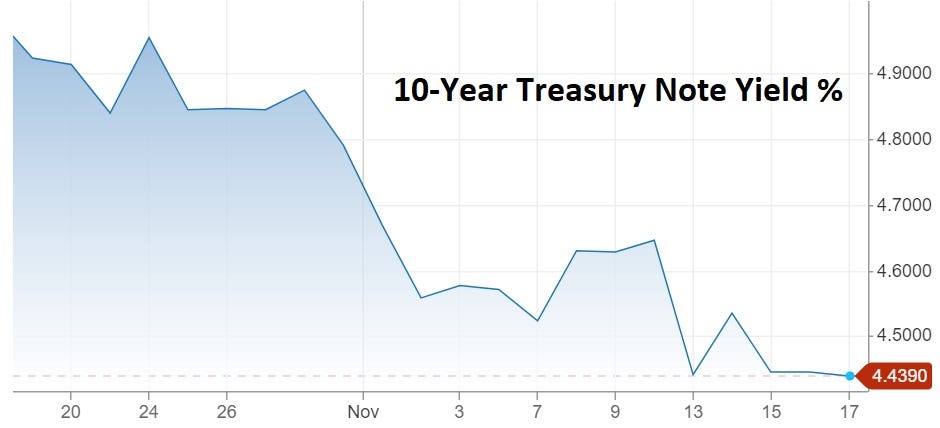

Interest rates are falling in response. After peaking at 4.95% in late October, the 10-year Treasury note yield is down to 4.4%. And the markets now expect the Fed to hold short-term rates steady for the next few months and then start cutting.

Stocks liked this new trend, staging a relief rally that took the S&P 500 up about 9% from its late-October low.

Disinflation good, deflation bad

Is this changing outlook for inflation and interest rates the good thing equity investors seem to think it is? Maybe not. A slowing rate of inflation (aka disinflation) is generally positive for financial asset prices, but actual falling prices (deflation) is usually bad for stocks because it lowers corporate profits. Which will we get? A lot of indicators are pointing to the latter. Some examples: