Last week’s smackdown of commodities stocks was painful to watch — unless you’re sitting on a pile of cash and waiting for those stocks to get even cheaper. For you, it’s now about “entry points,” specifically how to identify and exploit them.

More about this in a future post. But for now, suffice it to say that the economy and the markets seem to be living in two different worlds.

Macro news

The US was hit with another debt downgrade last week, this one from Moody’s.

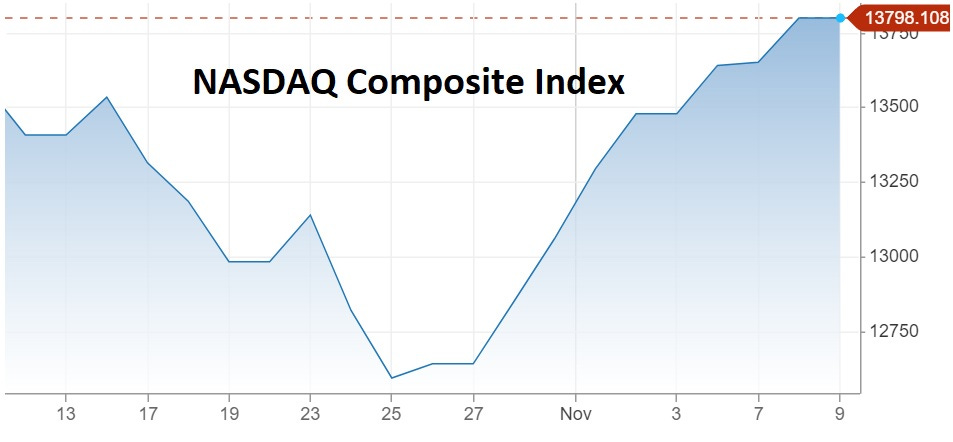

But it didn’t matter, as the combination of everyone losing interest in Ukraine — thus lowering the near-term odds of WW3 — and the Fed choosing not to raise interest rates for the second month in a row sent equities almost straight up.

But underlying market fundamentals continued to deteriorate:

Commercial real estate has been a slow-motion train wreck for the past year, and it just gained a new dimension with office management Ponzi scheme WeWork’s bankruptcy. This is bad news for the industry and even worse news for the small banks that own most commercial real estate.

Some other ominous real estate stats: