Going forward, these portfolio updates will switch from weekly to monthly, and the time thus freed up will go to deeper dives into specific portfolio companies that are doing interesting things.

Speaking of interesting, Friday was fun, no?

Here’s a concise version of the story:

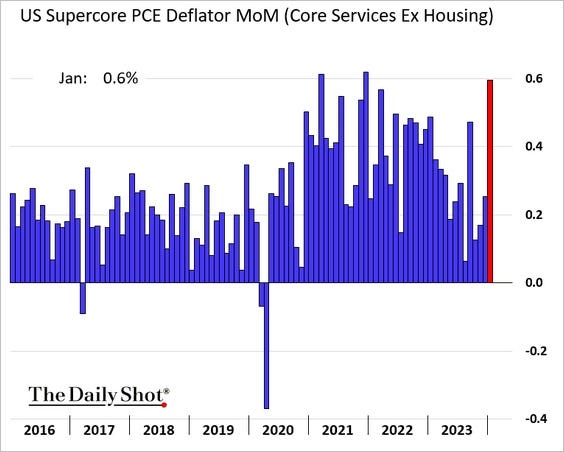

Last week a popular inflation measure — core services — came in unexpectedly hot, which led to speculation that interest rates will stay “higher for longer.”

Counterintuitively, both tech stocks and cryptocurrencies spiked, making the financial markets look suspiciously like the late-1990s dot-com bubble.

Then on Friday, the ISM’s PMI report came out weaker than expected, a Fed talking head made some dovish noises, and CNBC reported that the national debt is now rising by $1 trillion every 100 days. Gold immediately joined the party, gaining $38 to an all-time monthly closing high:

Adding fuel to gold’s sudden fire, GoldMoney’s head of research Alasdair Macleod commented on how gold futures contracts are being aggressively converted into physical:

The stand-out feature is the acceleration of deliveries — 2,005 gold contracts were stood for delivery this week, making the total for February 18,118 contracts, representing over 1.81 million ounces (56.35 tonnes).

The question which arises is where is it all going? We know that central banks are adding to their reserves, and for some of the minor ones a Comex contract allows them to jump the queue for delivery from the refiners. To this we can almost certainly add ultra-high net worth individuals and their family offices, not so much in the West, but one suspects in Asia, where new billionaires are being created: think India. Chinese demand continues apace, where deliveries out of the Shanghai Gold Exchange in January were a whopping 271 tonnes, only the second-highest figure to 285.5 tonnes in July 2015. In the last twelve months, these deliveries totaled 3,344 tonnes, which is approximately annual global goldmine output.

Mining analyst Jay Taylor interpreted Macleod’s data as follows:

So Asia appears to be gobbling up physical supplies of gold like there is no tomorrow. They want the physical stuff, not paper gold that Keynesian propagandists have taught us to be satisfied with. We know from the work that the Gold Antitrust Action Committee (GATA) has performed over the past couple of decades that there is something like 100 times more paper gold traded in the West than actual physical gold. But as the BRICS are moving seriously toward a multipolar gold-backed trading system, they want the real thing not imaginary gold. And as history shows, gold follows wealth.

Whew. Quite a week. Can’t wait for Monday.

Sector News

The other notable action was in uranium, which finally corrected after an epic run. This is to be expected and has no effect on the metal’s favorable long-term supply/demand outlook:

Other sector headlines:

New Solar Installations exceed 2500 GW by 2030. Doing the math means 1,250,000,000 ounces of Silver.

Super Bull Market in Gold About to Start - Charles Nenner

The PCE Inflation Report: Rocket Fuel For Gold!

Opportunities with growth-oriented gold producers