The first week of the year is typically pretty sedate on the news front, as traders ease back into the markets. The action will resume shortly. But in the meantime, a few interesting things did happen.

Macro news

Even the “good” numbers were bad last week. For example, the headline jobs number that dropped on January 5 looked strong but really, really wasn’t. Here’s how the government’s con works:

First, release a good headline number and get the MSM to play along:

U.S. Added 216,000 Jobs in December, Outpacing Forecasts

(New York Times) - The U.S. labor market ended 2023 with a bang, gaining more jobs than experts had expected and buoying hopes that the economy can settle into a solid, sustainable level of growth rather than fall into a recession.

Employers added 216,000 jobs in December on a seasonally adjusted basis, the Labor Department reported on Friday. The unemployment rate was unchanged at 3.7 percent.

Then, after everyone has soaked in the exciting news and formed favorable opinions about US leadership, dribble out the real story as follows:

Revise previous months’ employment numbers down to levels that an honest reporter would have to call “extremely disappointing.” But because it’s a revision, no one cares.

Quietly note that the number of full-time jobs actually fell while the number of part-time jobs soared. Since even people with part-time jobs are considered “employed,” this lowers the unemployment rate while vastly overstating the number of people supposedly making a living wage.

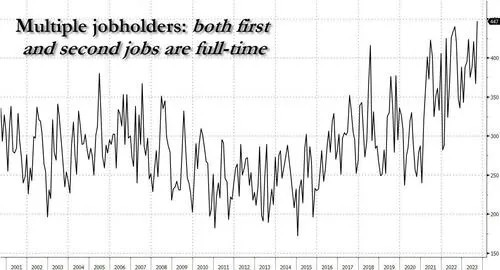

Even more quietly report that a rising number of people with full-time jobs are being forced to take second full-time jobs — which sounds terrible.

So when Establishment figures like Paul Krugman wonder why the peasants aren’t happy in this best of all possible worlds, it’s because actual life is a lot harder than the headline numbers make it seem. A more related data points:

The services economy is slowing. The ISM Services PMI (a measure of service sector strength) had been projected at around 52.6 but plunged to 50.6. ISM Services Employment fell from 50.7 to 43.3. (Anything below 50 indicates contraction.)

European inflation is rising. Germany's inflation rose from 3.2% to 3.7%, while overall EU rose from 2.4% to 2.9%. Can the ECB cut rates with inflation rising? Maybe not.

To sum up, the past week’s macro news was actually a lot worse than the headlines implied.

Sector news

As Uranium Price Continues To Rise, Sprott Warns On Supply Chains

(NucNet) - The uranium price hit $91/lb this week, its highest since 2007, but the global pivot back to nuclear energy is creating challenges such as the need to rebuild supply chains that have “long since disappeared”, John Ciampaglia, chief executive officer of Sprott Asset Management, which runs the Sprott Physical Uranium Trust, said in a blog post on Wednesday (3 January). Read more here.

Copper could skyrocket over 75% to record highs by 2025 — brace for deficits, analysts say

(CNBC) - Copper prices are set to soar more than 75% over the next two years amid mining supply disruptions and higher demand for the metal, fueled by the push for renewable energy.

Rising demand driven by the green energy transition and a likely decline in the U.S. dollar in the second half of 2024 will push copper prices higher, according to a report by BMI, a Fitch Solutions research unit.

Additionally, at the recent COP28 climate change conference, more than 60 countries backed a plan to triple global renewable energy capacity by 2030, a move that Citibank says “would be extremely bullish for copper.”

In a December report, the investment bank forecast that the higher renewable energy targets would boost copper demand by extra 4.2 million tons by 2030.

This would potentially push copper prices to $15,000 a ton in 2025, the report added, way higher than the record peak of $10,730 per ton scaled in March last year.

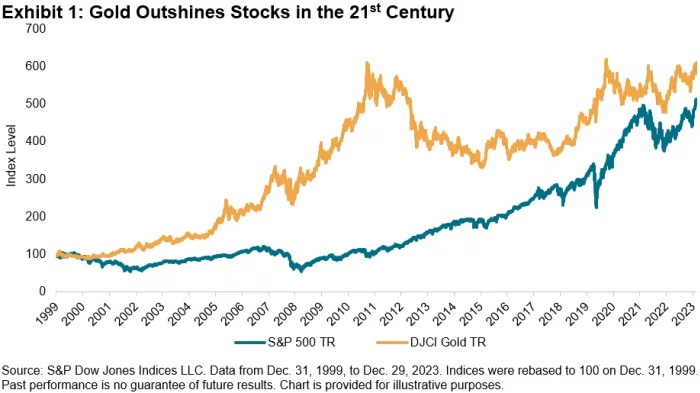

Gold still outshining stocks and bonds since the turn of the century

(MarketWatch) - No yield, no dividend, no problem?

That appears to be the case for gold when it comes to its performance against both stocks and bonds as the calendar flips ever deeper into the 21st century. The chart below from S&P Dow Jones Indices shows the relative performance of the yellow metal, as measured by Dow Jones Commodity Index Gold, versus the S&P 500 SPX, between Dec. 31, 1999, and Dec. 29, 2023.

Going back to the start of the century, DJCI Gold produced a 7.8% annual return, compared to a 7% return for the S&P 500 during that time, said Brian Luke, head of commodities, real and digital assets at S&P Dow Jones Indices, in a blog post this week.