Macro News

Tech layoffs balloon in January

(CNBC) - The S&P 500 is trading at a record and the Nasdaq is at its highest in two years. Alphabet shares reached a new pinnacle on Thursday, as did Meta and Microsoft, which ran past $3 trillion in market cap.

Don’t tell that to the bosses.

While Wall Street cheers on Silicon Valley, tech companies are downsizing at an accelerating clip. So far in January, some 23,670 workers have been laid off from 85 tech companies, according to the website Layoffs.fyi. That’s the most since March, when almost 38,000 people in the industry were shown the exits.

Activity picked up this week with SAP announcing job changes or layoffs for 8,000 employees and Microsoft cutting 1,900 positions in its gaming division. Additionally, high-valued fintech startup Brex laid off 20% of its staff and eBay slashed 1,000 jobs, or 9% of its full-time workforce.

Read the rest here.

Trouble for the U.S. economy? Empire State gauge sinks to lowest level since pandemic.

(MarketWatch) - A survey of business conditions in the New York region sank in January to the lowest level since the onset of the coronavirus pandemic in 2020, perhaps a sign of trouble brewing for the U.S. economy.

The New York Federal Reserve’s Empire State business-conditions index, a gauge of manufacturing activity, plunged 29.2 points to negative 43.7, the regional Fed bank said Tuesday. The index for new orders dropped 38.1 points to negative 49.4 in January. Shipments fell 24.9 points to negative 31.3 points.

This is the second-lowest reading ever. The biggest drop took place in the depths of the pandemic, in May 2020.

Unfilled orders continued to shrink significantly, and delivery times have shortened, which usually happens when business dries up. Employment and hours worked also contracted.

Read the rest here.

Iran-Backed Groups Kill Three US Troops In Jordan

An overnight drone attack on a US military outpost in northeast Jordan has killed three American troops and left 25 more injured, according to breaking reports Sunday morning.

The outpost, called Tower 22, is located very close to the Syrian border, and the casualty rate is so high as soldiers were reportedly sleeping in tents when the drone struck. By all accounts thus far, the drone appears to have come from Syrian territory.

President Joe Biden issued a statement announced the attack on Americans, saying that "radical Iran-backed militant groups" in Syria and Iraq were behind it.

Read the rest here.

Sector News

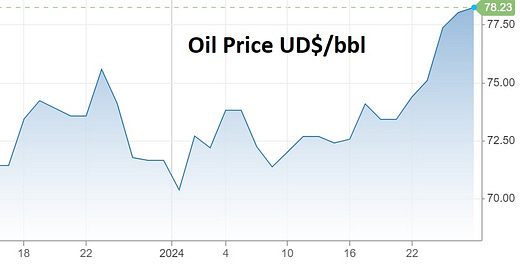

Gold and uranium held most of their recent gains last week, while oil retraced some of its losses.

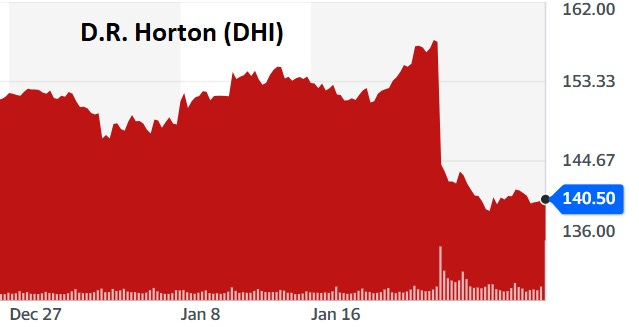

Housing — which we’ve been (painfully) short for the past year, may finally be cracking under the weight of unaffordable prices and high mortgage rates:

D.R. Horton Sheds Some Light on the Massive Costs of Mortgage Rate Buydowns

(Wolf Street) - Homebuilder stocks tanked on Tuesday after D.R. Horton’s earnings call, with its stock down 9.2%.

Part of the problem was that the gross profit margin on home-sales revenue dropped by 220 basis points from the prior quarter, to 22.9%, executives said during the earnings call with analysts.

Mortgage-rate buydowns are the most successful incentive homebuilders have. But they’re an expensive incentive in unexpected ways. The massive swing in mortgage rates during the quarter had caused its hedges on those buydowns to lose market value and essentially become useless when mortgage rates dropped. The hedges needed to be restructured, and it triggered the $65 million charge to cost of goods sold.

On top of that, D.R. Horton said it had increased the use of the buydowns during the quarter, that 70% of its deals were made with mortgage-rate buydowns, up from 60% in the prior quarter; and that 80% of the mortgages originated by its mortgage company, DHI Mortgage, were done with buydowns.

Read the rest here.