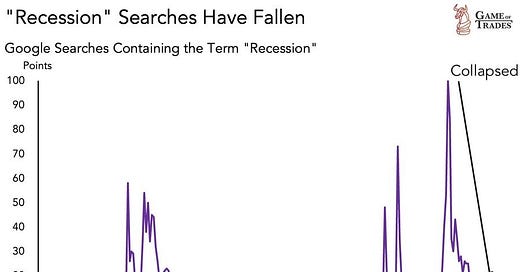

Lately, the consensus has shifted from “imminent downturn” to “don’t worry, it’ll be fine.” Google reports that hardly anyone is searching for the term “recession” anymore:

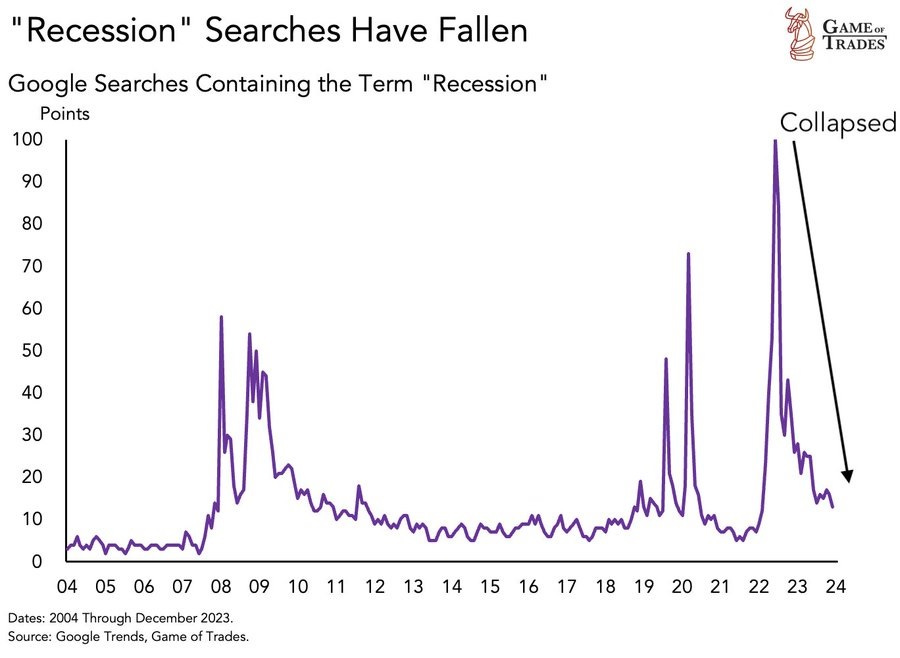

In response, stocks rose to record highs last week…

… further increasing the market’s dependence on the “Magnificent 7” Big Tech stocks:

Interest rates, meanwhile, reclaimed some of their recent losses:

Will overpriced, over-concentrated stocks slam into higher interest rates in 2024? Very possibly. Stay tuned.

Sector News

Uranium had another big week, as strong demand bumped up against supply concerns:

Gold bounced off of $2000, as that level (here’s hoping) gradually becomes support rather than resistance.

In other news…

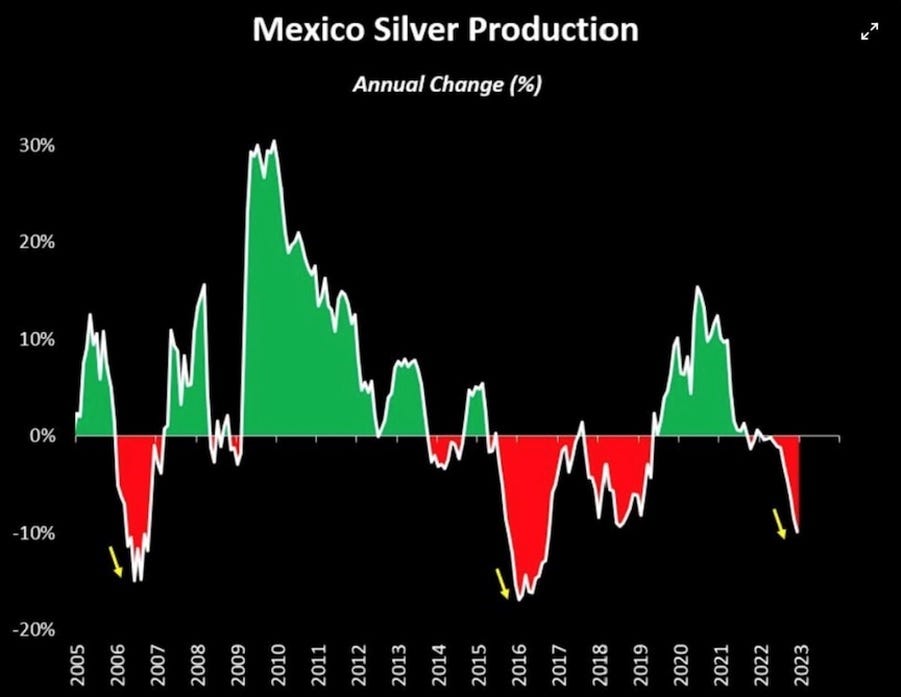

Mexico’s silver production — and its silver reserves — are plunging

(Ahead of the Herd) - Mexico, the world’s largest silver producer, could mine all of its existing reserves within two years, throwing silver’s global supply-demand balance even further out of whack than it is currently.

Silver production there is now declining double digits annually for the first time in almost a decade. This year, output is expected to fall by 16 million ounces because of the suspension of operations at Newmont’s Penasquito mine due to a strike. (The Silver Institute)

The rest is here.

2024 is setting up to be a historic year for gold

(Doomberg) - With the price of everyone’s favorite precious metal recently setting a new all-time high (as measured in US dollars, at least), is 2024 going to be gold’s year? Let’s crack open the vault and indulge in some informed speculation.

The rest is here

Central Banks Are Still Buying Gold

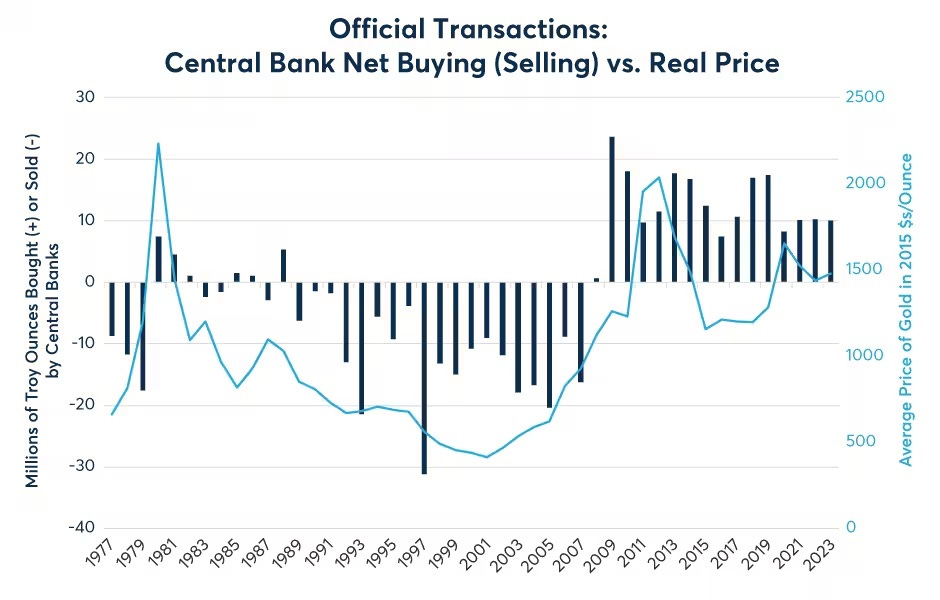

(CME Group) - The central banks’ post-GFC gold buying contrasts sharply with the time when central banks were net sellers of gold from 1982 to 2007. This implies that pre-GFC central bank policy entrusted fiat currencies like the U.S. dollar, euro, yen, pound and Swiss franc as reserve assets more than gold. This relationship reversed since the GFC. By all accounts, that tendency continued in 2023 despite central bank rate increases boosting returns on fiat currencies to their highest levels since 2007.

Figure 1: After decades as net sellers, central banks became net buyers of gold after the financial crisis

The rest is here.

Prediction: Uranium Prices Could Eclipse $400 a Pound

(Nomi Prins) - Late last year, global interest in nuclear energy surged.

About 60 new nuclear reactors are in construction around the world, with another 110 planned to begin construction. The U.S. and Britain pledged to triple their nuclear energy use by 2050. That means more global demand for uranium.

As part of that pledge, the U.K. released a “Civil Nuclear Roadmap” with plans for the biggest expansion of nuclear power in 70 years. That plan will include an almost $400 million (£300 million) investment in fuels needed to power high-tech nuclear reactors.

The rest is here.

December home sales slump to close out worst year since 1995

(CNBC) - Sales of previously owned homes fell 1% in December compared with November to 3.78 million units on a seasonally adjusted annualized basis, according to the National Association of Realtors. Sales were 6.2% lower than in December 2022, marking the lowest level since August 2010.

Full-year sales for 2023 came in at 4.09 million units, the lowest tally since 1995.

The rest is here.