Weekly Portfolio Update, January 14 2024

Great week for uranium, decent week for gold, bad week for the economy

Macro News

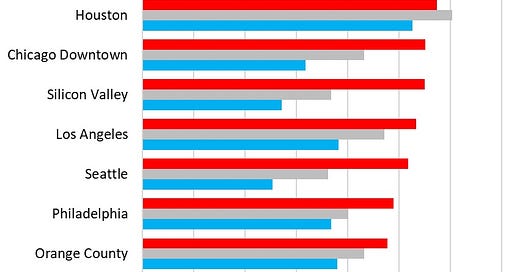

Corporate layoffs accelerated last week, while office vacancy rates continued to rise:

Inflation, meanwhile, has stopped falling, which might limit the Fed’s ability to cut interest rates even in the face of slowing growth:

Last but not least, geopolitics became even scarier. From GoldMoney’s Alasdair Macleod:

The geopolitical year ahead

2024 will see a quickening pace for geopolitical developments, with the influence of the US waning while that of China and Russia waxes.

As a lost cause, the war in Ukraine will be abandoned by America and NATO in the next few months. The dangers in the Gaza situation are likely to escalate, with the US being played by Iran acting in collusion with Russia through the Houthis.

The days of US divide and rule over Middle Eastern states are over. And if Israel thinks it can simply drag America into the Gaza horror story it has badly miscalculated.

Russia has taken over the presidency of BRICS, and in his New Year speech President Putin stated there will be over 200 meetings and events planned. The final definitive meeting will be in Kazan in October. It seems reasonable to assume that Russia will ensure that all current members will be educated towards the merits of adopting a gold-backed trade settlement arrangement instead of the dollar.

The new currency is likely to replace the dollar as the intermediate step between non-dollar currency transactions. And it also makes compelling sense for Russia to put the rouble on a gold exchange standard as well, because it is one of the few economies that won’t require cuts in public spending to facilitate it. And as the dollar slides, China must follow in order to prevent the yuan going down with it.

Read the rest here

Sector News

Uranium got a jolt from its biggest producer. As the Independent Speculator’s Louis James reports:

The most immediate and important game-changer for us as resource investors is Kazatomprom’s announcement yesterday that it “expects adjustments to its 2024 production plans” due to supply chain problems and construction delays.

Specifically (emphasis mine): “While actively pursuing alternative sulphuric acid supplies, current projections indicate that the Company’s intention to achieve 90% production volume as per Subsoil Use Agreements in 2024 may be challenging.”

Further ahead: “Updated 2025 production plans are expected to be communicated around the H1 2024 results disclosure but successful return to a 100% of the Subsoil Use Agreements can be viewed as at risk.”

Spot uranium popped on the news, with the Broker Price Index leaping $4 per pound to $104.

Gold meandered but stayed above $2000/oz. The longer it stays in its current range, the easier it will be for investors to view $2000 as support rather than resistance.

Sprott’s John Hathaway posted an extensive look at gold and the miners, why they’re undervalued, and how we should approach the sector:

Gold Mining Stocks, A Clear and Compelling Investment Case

We offer herein an investment rationale for gold mining equities that rests primarily on investment fundamentals particular to the mining sector. Speculation on the future course of the gold price takes a back seat. A tailwind from higher metal prices would, of course, be helpful but in our view would only add heft to an already powerful investment case.

Extreme Undervaluation

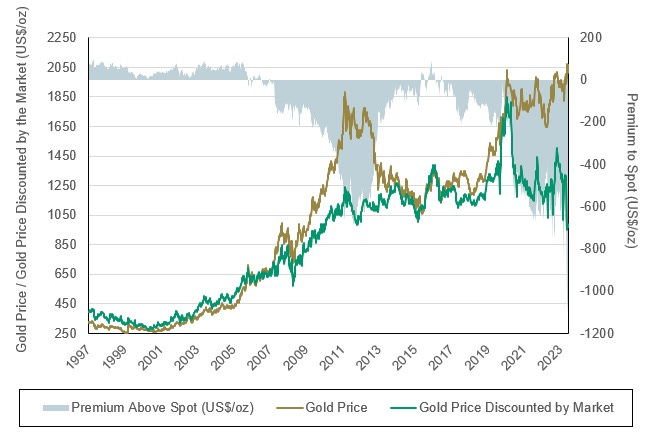

Gold mining stock valuations are the lowest in 25 years. The spread between the gold price and the discount implied to spot based on the market price of the equities is a massive $700+ per ounce. In other words, cash flow from a gold price 65% of the current spot price would return the entire market value of the group based on existing reserves. BMO calculates an average return on capital of 14.4% for mid-capitalization producers and 25.8% for small-cap producers in a semi-liquidation scenario (see Figure A2). We believe investment returns would be substantially greater in a full liquidation scenario, which would assume the elimination of all discretionary capital spending. In essence, the theoretical returns from taking many of the mid- and small-cap producers private would be compelling from the perspective of a corporate raider. The "corporate raider" perspective is of course only a notional concept to illustrate the extreme undervaluation of the sector. The risk typically associated with extreme undervaluation is the amount of time required for the investment thesis to prove out, not loss of capital.

Read the rest here

Oil analyst Doomberg dropped a bombshell on that market by predicting that new technologies will increase the amount of available oil, thus delaying the expected production peak for decades, if not forever. The video follows. For a dissenting view, see Peak Prosperity’s Chris Martenson in the “Videos” section of this post.