Weekly Portfolio Update, February 11, 2024

Overvalued stocks and rising interest rates are a volatile mix

Another week of rising tech and falling commodities. This is painful but temporary because overvalued stocks and rising interest rates don’t coexist for long. Meanwhile (with the exception of uranium, which has had a great year), commodities and their miners are now crazy cheap.

Macro News

US government debt to top $54 trillion in next decade, CBO says

As the S&P 500 breaches 5,000, its valuation hits lofty levels as well

Corporate insiders are dumping their shares

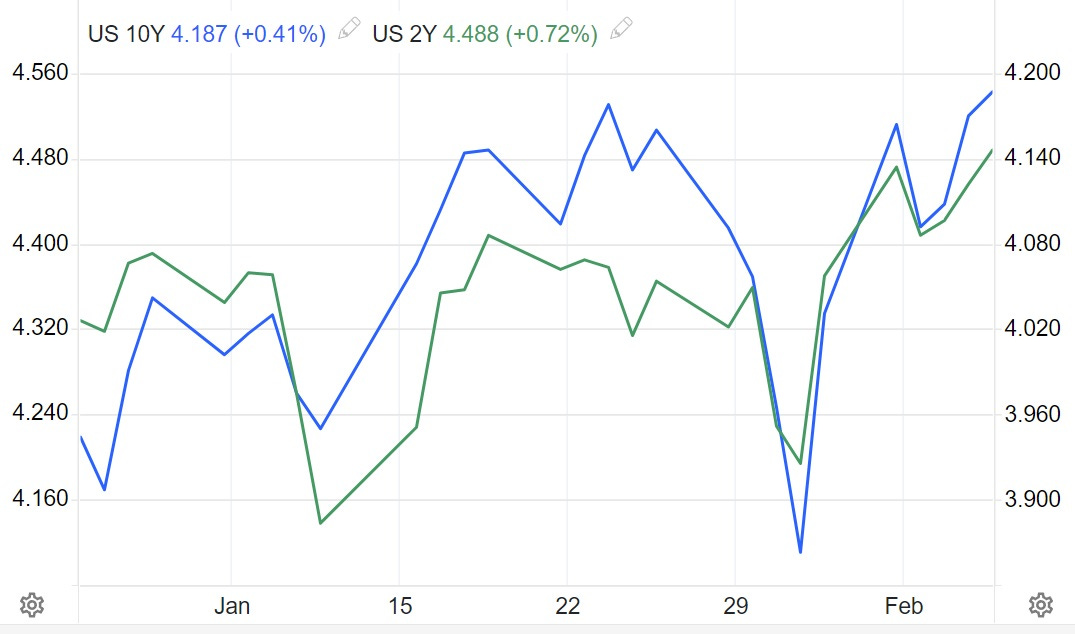

2-year, 10-year Treasury yields at highest levels since December after modest CPI revisions

Sector News

Why gold will continue to rise

The mining industry is dogged by retirements and lack of new recruits

2023 was a record year for gold demand

Oil stocks should be popular like semis, but no one cares

Silver is the new gold as Egyptians try to protect their savings

Correction ahead for the uranium market

China’s central bank buys 10 tonnes of gold, extending its buying spree

Gold market hides massive shift. Global demand is now price-insensitive

China’s equity slide is supercharging gold demand

Bitcoin surges above $48k, Ether reclaims $2,500 as the crypto bull heats up

US commercial real estate contagion is now moving to Europe

Median home prices are falling at the fastest rate since 1964

Regional bank hit with third credit downgrade as crisis concerns linger