Last week the Fed said some hawkish things…and stock prices spiked. Counterintuitive? Indeed.

Something else is clearly going on, and that thing is artificial intelligence. In just the past couple of years, computer systems have begun to do things that seem eerily superhuman, and pretty much every major business is now racing to incorporate those abilities. The processing chips that make AI possible are in unprecedented demand and the companies that produce them are soaring like late-1990s dot-coms, led by the OG of this space, Nvidia, which has added a breathtaking $1 trillion in new market cap in just a few months.

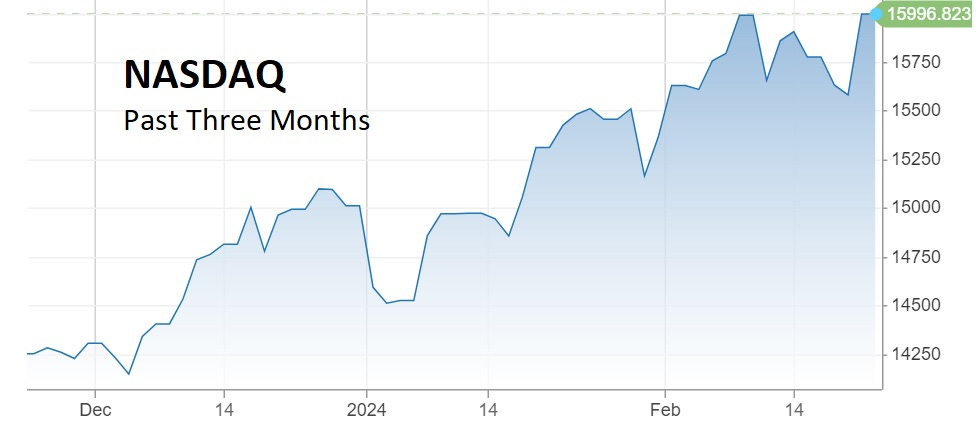

The NASDAQ exchange, where most Big Tech companies trade, is being levitated by Nvidia and a handful of other AI stocks, and is now at an all-time high:

So it’s official. We’re back in a tech stock bubble, with all that that implies for near-term volatility and an eventual crash. Buckle up.

Sector News

Saudi’s Aramco discovers 15 trillion cubic feet gas reserves in Jafurah field

Uranium Stocks Magnetically Drawn To The 50-Day Moving Average

Top 10 Uranium Producing Companies In The World

The Top 10 Producers Leading A Global Shale Bonanza

‘Bad news for home buyers’: Mortgage rates rise for third week in a row

Swiss gold exports hit six-year highs on demand from China and India

Luxury Homebuilder Toll Brothers Earnings Jump

Central banks are turning to gold as they lose faith in bonds - ANZ

Gold at $3,000 and oil at $100 by 2025? Citi analysts don’t rule it out

Portfolio Company News

While tech was rocking, commodities meandered. Uranium corrected after a great run, gold held above $2000/oz, and copper, silver, and oil were more or less unchanged. But this is earnings season, and a lot of miners reported very good results. Operationally, commodity companies are doing much better than their share price action would imply. The past week’s headlines: