Weekly Portfolio Update, February 18 2024

Rising inflation and slowing growth... Is this stagflation?

Last week was definitely not boring. First, inflation jumped, leading investors to revise their interest rate outlook from “multiple cuts” to “higher for longer.” Then retail sales plunged, pointing to weaker-than-expected year-ahead growth. Combine those two trends and the result might be 1970s-style stagflation. So do your stacking while you still can.

Macro News

January wholesale prices rise more than expected, another sign of persistent inflation

US retail sales plunged in January, the worst YoY growth since COVID crackdown

Paramount Global lays off about 800 employees a day after announcing record Super Bowl ratings

Another ‘Great Retirement’ wave hits the US after stocks rally

Sector News

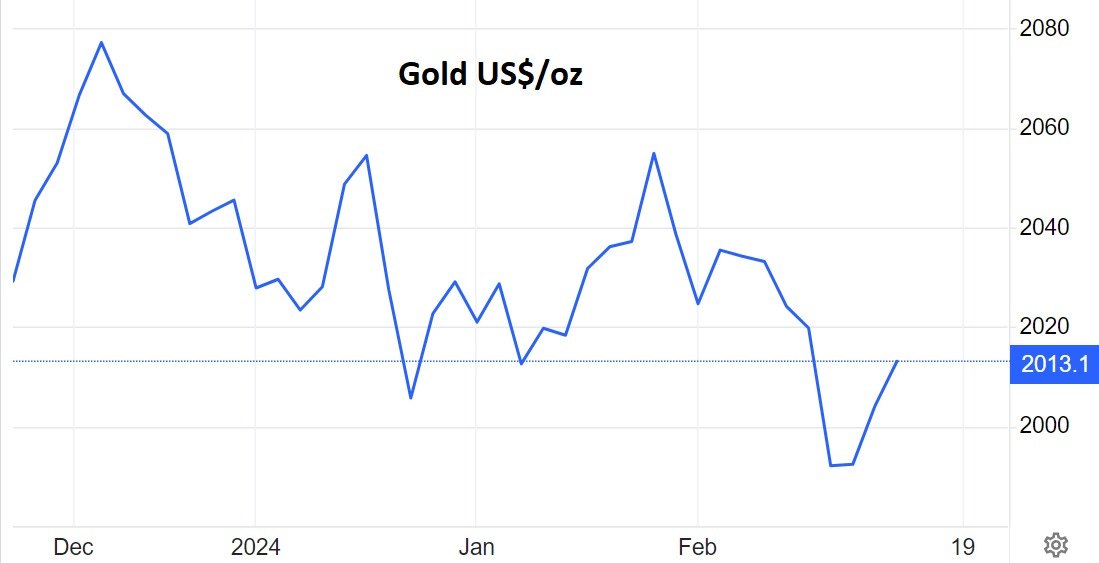

Gold fell below $2000/oz for a few hours last week but quickly recovered. So the jury is still out on the “$2000 is now support” thesis:

Other headlines:

Uranium prices could rally past 16-year highs as the world’s largest producer runs short

2023 was a record year for gold demand

Major oil companies make moves in megamerger frenzy

US homebuilders weigh incentives as mortgage rates rise

Mortgage rates shoot to 2-month high after new report shows inflation is still hot

Barrick Gold’s Q4 earnings rise sequentially and y-o-y

In latest oil megadeal, Diamondback buys Endeavor for $26BN creating Permian giant

Mexico’s president calls for ban on open-pit mining

Kinross Gold Q4 earnings conference call

Agnico Eagle reported record production, cash flow

Portfolio Company News

Strong earnings and the usual stellar drill results: