The Goldilocks macro numbers kept coming last week, including a perfect right-down-the-middle jobs report and plunging inflation expectations.

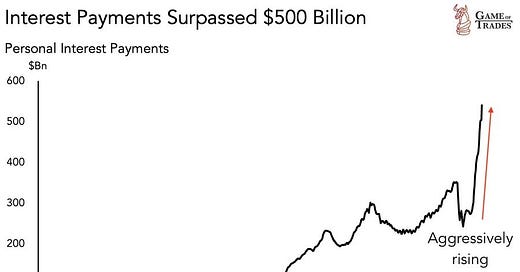

But these are just transitional stats on the way to a much darker 2024. The reason is simple: The imbalances that built up over the past decade can only be resolved with a nasty contraction. To take just one of many examples, as Americans pay for more of their day-to-day living with credit cards, personal interest expense has spiked:

So consumer spending (70% of the US economy) will be limited until this drain on disposable income stops. And that can only happen via 1) plunging interest rates or 2) the elimination of a big chunk of today’s credit card, auto, and mortgage debt through default. In other words, a major recession is required to bring things back into balance. And it will happen during a presidential election, with major geopolitical crises on the front burner and probably a banking crisis here at home. In other words, 2024 might be the opposite of a soft landing/Goldilocks economy.

Sector news

Russian uranium import ban teed up for US House floor vote

(Mining.com) - Legislation that would bar the import of enriched Russian uranium into the US has been teed up for a vote in the US House of Representatives.

The Prohibiting Russian Uranium Imports Act, by Washington Representative Cathy McMorris Rodgers, has been scheduled for consideration next week under an expedited procedure that requires two-thirds majority to pass, according to the House floor schedule.

Support for a ban on the import of nuclear reactor fuel from Russia is growing among both Democrats and Republicans following Russia’s invasion of Ukraine. Its backers have been seeking to attach the measure to must-pass legislation, according to people familiar with the matter. House passage of a standalone bill would set up the opportunity pass the same legislation in the Senate.

The House legislation would increase the cost of nuclear fuel in the US by 13%, according to an analysis by the non-partisan Congressional budget estimators.

Nations rally behind renewables — including nuclear — at COP28 climate talks

(France24) - Nearly 120 nations pledged to triple the world's renewable energy within seven years at UN climate talks Saturday as the United States pushed to crank up nuclear capacity and slash methane emissions.

In a declaration, countries ranging from Britain to Ghana, Japan and several European nations said nuclear power had a "key role" in achieving carbon neutrality by mid-century.

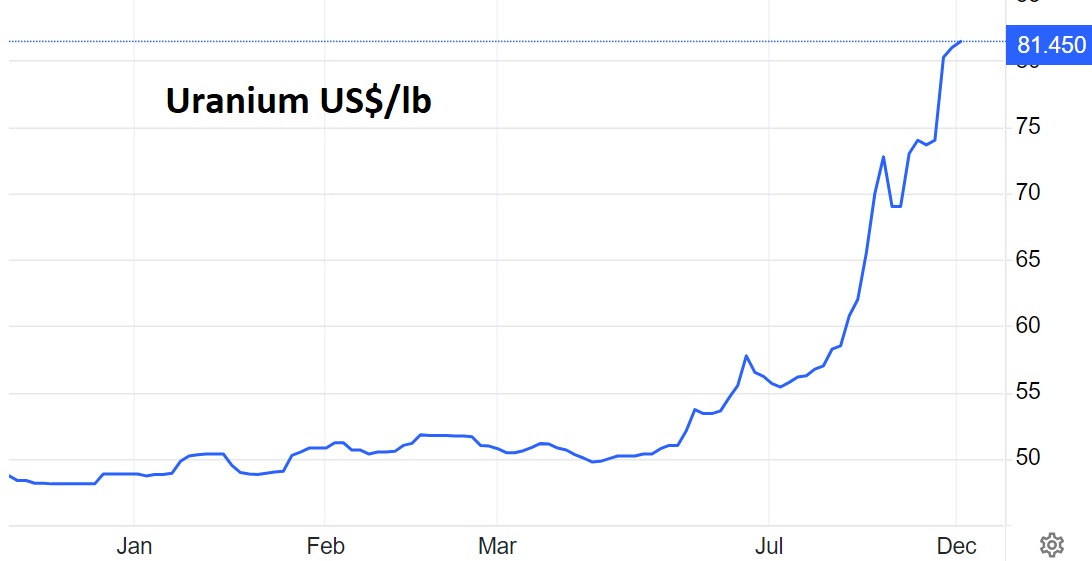

Uranium’s spot price hit another multi-year high:

Oil price declines for seventh week on supply and demand worries

Oil prices rallied Friday, but still booked the seventh straight week of losses as record production and demand worries weigh on prices.

The West Texas Intermediate contract for January rose $1.89, or 2.73%, to settle at $71.23 a barrel. The Brent crude contract for February gained $1.79, or 2.42%, to settle at $75.84 a barrel.

U.S. crude and the global benchmark lost about 4% for the week despite Friday’s rebound. The last time WTI booked a seven-week losing streak was five years ago.

Meanwhile, Saudi Arabia and Russia, the world’s two biggest oil exporters, on Thursday called for all OPEC+ members to join an agreement on output cuts just days after a fractious meeting of the producers’ club.

The Organization of the Petroleum Exporting Countries and its allies last week agreed to a combined 2.2 million barrels per day (bpd) in output cuts for the first quarter of next year. The market has been concerned, however, that some members may not adhere to their commitments.

U.S. Gasoline Prices Continue Falling as Futures Hit Two-Year Low

U.S. gasoline futures slumped this week to the lowest level since 2021, suggesting that the average American pump price will continue to drop and end the year below $3 per gallon.

On Thursday, the NYMEX RBOB gasoline futures contract dropped below the $2 per gallon mark, as demand is weakening and supply is building. The benchmark gasoline futures fell to below $2 a gallon for the first time since 2021.

The latest inventory report from the EIA showed an inventory build of 5.4 million barrels of gasoline for last week. This compared with a build of 1.8 million barrels for the previous week.

At the same time, U.S. gasoline demand between Sunday and Wednesday was 5.7% below the same period last week, according to GasBuddy data reported by its head of petroleum analysis Patrick De Haan.

The drop in the NYMEX RBOB gasoline futures “signals a strong possibility” that the national average U.S. gasoline price will fall to $2.99 per gallon by Christmas if it can remain at or below that level, De Haan said.

Gold briefly touched an all-time high before hitting resistance: