Two weeks before the Fed’s December 13 meeting, Chairman Jerome Powell poured a bucket of cold water on the financial markets with this:

“It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease.”

Then came the phone call (I’m speculating here), in which the White House reminded Powell that 2024 is an election year, and if anyone associated with the Fed hoped for a future life among the political glitterati, interest rates had better start falling.

So, like good little bureaucrats, Powell & Co. shifted gears, promising at their December 13 meeting to stop raising and start cutting. The (huge) implied message is that normal interest rates are simply unsustainable, and henceforth rates will be low and money easy for as far as the eye can see.

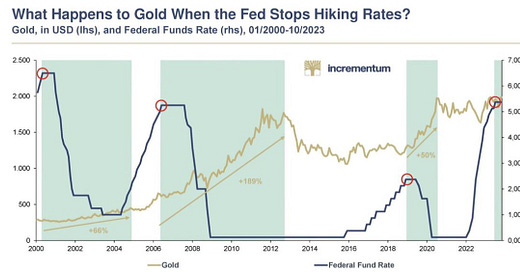

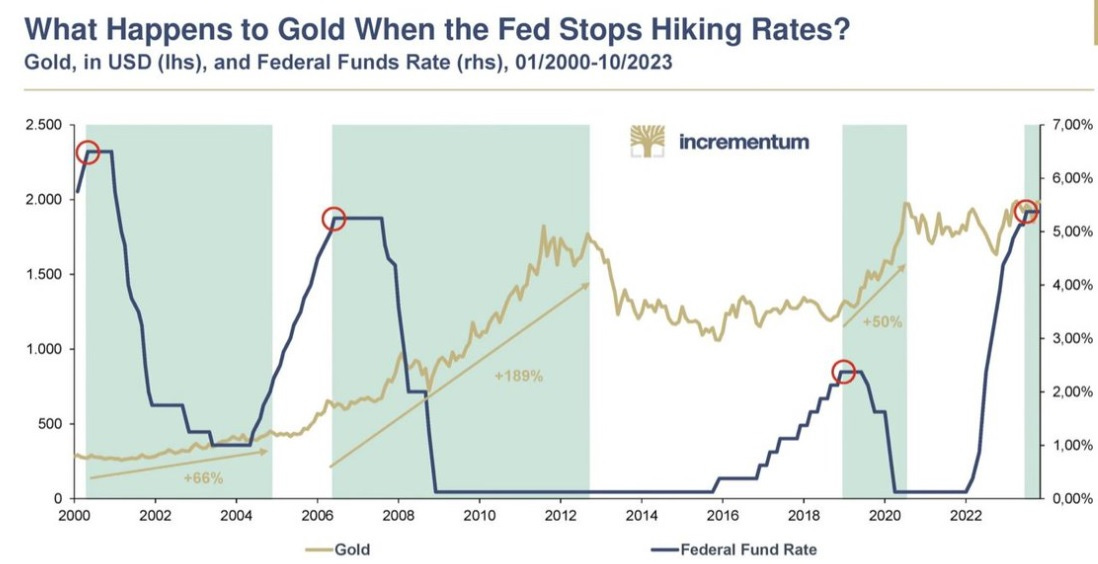

Overjoyed financial markets responded with an epic relief rally in which cash poured out of money funds and into pretty everything else, including gold and silver. Gold is now back above $2000/oz — for the fourth time in 3 years — but the difference this time is that money is getting easier rather than tighter, which historically has been great for precious metals.

Sector news

Costco sold more than $100 million in gold bars last quarter

(CNBC) - Costco has found a new hit with online shoppers — gold.

The retail warehousing giant sold more than $100 million of the precious metal in its fiscal first quarter, which ended Nov. 26, Costco Chief Financial Officer Richard Galanti told analysts during the company’s earnings call Thursday.

The 1-ounce bars typically sell out within a few hours after they are loaded to Costco’s website, Galanti said back in September. The gold bars were listed at a price of $2,069.99 an ounce on Friday on the website, higher than the latest spot price of $2,020.58.

M&A deals in Permian basin exceed $100 billion in 2023

(Reuters) - The value of U.S. oil and gas mergers and acquisitions in the Permian basin this year has reached a record of more than $100 billion after several multi-billion dollar deals, consultancy Wood Mackenzie said in a news release on Tuesday.

Those include blockbuster deals such as Exxon Mobil's $60-billion proposed deal for Pioneer Natural Resources PXD.N and Chevron's $53-billion agreement for Hess.

Occidental's purchase of CrownRock announced on Monday will create the sixth producer in the lower 48 U.S. states of 1 million barrels of oil equivalent per day, with others including Chevron, EOG, ExxonMobil, EQT and ConocoPhillips, Wood Mackenzie said.

In the Permian specifically, Occidental will become a top three producer behind the majors, pumping more oil and gas pro-forma than Pioneer did at the time of its sale announcement.

It’s Happening: Miss America and Uncle Sam Go ALL IN On Nuclear

(Katusa Research) - This week, there are 4 major developments in nuclear power you need to know:

Uncle Sam Pushes the Red Button: NO RUSSIA

In a major move this week, the U.S. House of Representatives passed bill H.R. 7403 (117th), the National Opportunity to Restore Uranium Supply Services In America Act (NO RUSSIA Act) of 2022.Also approved was a separate but related piece of legislation, bill H.R. 1042 (118th), the Prohibiting Russian Uranium Imports Act. Combined, these two bills are a clear response to reduce Russian influence in the U.S. uranium market and both enjoy widespread bipartisan support.

This program aims to revitalize the U.S. uranium industry, vital for fueling 93 nuclear reactors and military nuclear needs. With these reactors requiring nearly 50 million pounds of uranium yearly, a steady, secure supply is crucial.

Miss America Goes Nuclear

Grace Stanke, Miss America 2023, is using her newfound fame to push for one specific form of zero-carbon energy. And for good reason: after studying as a nuclear engineer, Grace is especially qualified to teach people the truth about the world’s safest zero-carbon energy source: nuclear energy.Most importantly, she wants to squash the widely accepted view that nuclear power is dangerous and expensive.

The AI Energy Challenge: A Computing Power Explosion

AI development has seen an unprecedented surge in computing power requirements. Since 2010, the energy needed to train AI systems has been doubling every six months – a dramatic acceleration from the previous two-decade norm.This surge signifies a looming challenge: AI’s future advancements hinge on massive energy availability. The world’s most advanced supercomputers consume power equivalent to tens of thousands of homes.

Enter the Radioactive Elephant in the Room

Kazakstan’s Kazatomprom, the world’s largest uranium miner, has announced plans for a Strategic Uranium Reserve (A SUR Thing) that now has plans to purchase $500 million dollars of physical uranium.

Surging Industrial Demand for Silver means Structural Deficit set to Intensify

(Bullion Star) - There has been a significant imbalance in the physical silver market for the last 3 years with annual silver demand exceeding annual silver supply.

This is a problem since when silver demand is greater than silver supply, the extra demand (deficit) must be met by eating into the world’s finite and limited above-ground silver stockpiles.

This silver deficit has been so persistent and systemic that it is being described by the Silver Institute as a ‘structural deficit’ i.e. a prolonged deficit that is due to underlying ‘structural’ factors (technological advances and a sharply growing industrial demand), in an environment where supply (mine production and recycling) is unable to adjust upwards to keep pace with demand.