The Gold/Silver "Rebalancing" Correction Will Run Its Course

Just the price of success

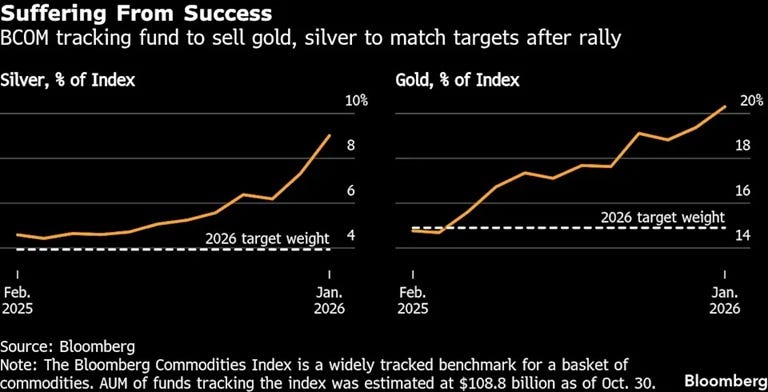

Think of what’s happening to gold and silver this week as the price of success. They rose so much over the past year that funds that hold commodity futures contracts now have to sell some of their gold/silver positions to maintain the required balance in their portfolios.

In other words, this is a very short-term issue. Here’s an explanation from Bloomberg:

Gold, Silver Fall as Traders Brace for Wider Index Rebalancing

(Bloomberg) -- Gold and silver fell for a second day, with investors positioning for an annual rebalancing of commodity indexes that will see futures contracts worth billions of dollars sold in the next few days.

Spot gold slipped below $4,450 an ounce, after losing nearly 1% in the previous session. Passive tracking funds are selling precious metals futures from Thursday to match new weightings required by the indexes – a usually routine process that has taken on extra significance for gold and silver due to last year’s blistering rallies.

Silver – which fell more than 3% on Thursday – is particularly vulnerable to a sharp selloff. Citigroup Inc. estimated about $6.8 billion in silver futures could be sold to meet the rebalancing requirements, equivalent to about 12% of open interest on Comex.

Outflows from gold futures will total roughly the same amount, according to Citi, basing its estimate on funds tracking the Bloomberg Commodity Index and the S&P Goldman Sachs Commodity Index. The rebalancing is needed because of the sharp rise in the weighting of precious metals in commodity benchmarks.

The Bloomberg Commodities Index roll period runs from the sixth business day of the year to the tenth, but is typically at a one-day lag to the trading done to rebalance the index, which is usually evenly spread across the fifth business day to the ninth.

Both metals faced a similar index selloff last year, without causing a discernible drag on the market, according to a Dec. 12 note from JPMorgan Chase & Co. The bank, however, said the amount of selling required in silver is more outsized this year.

“I’ve been running this process for many years, and we haven’t seen any outsized flow like this one,” said Kenny Hu, a strategist at Citi.

Though prices may come under short-term pressure, analysts are still broadly bullish on gold, after chalking up its best annual performance since 1979. Bullion hit a series of records throughout last year, with support from elevated central-bank buying and inflows to bullion-backed exchange-traded funds. A sagging US dollar added further fuel to prices, making the metal more affordable for buyers in other currencies.

“The rally is fueled by a potent mix of safe haven and risk-off purchases, spurred in part by USD weakness, and policy uncertainty,” wrote James Steel, chief precious metals analyst at HSBC Holdings Plc. Steel sees gold hitting $5,000 an ounce in the first half of 2026, bolstered by rising geopolitical risks and rising fiscal debts.

It’s all about reducing futures. Paper silver. What a charade! Like reducing your consumption of imaginary somewhere in the future hamburgers because your dietician told you to reduce your hamburgers intake. Reality inverted

Thank you John, for your insights to gold and silver, they have been very helpful in understanding the market and I look forward to additional commentary going forward.