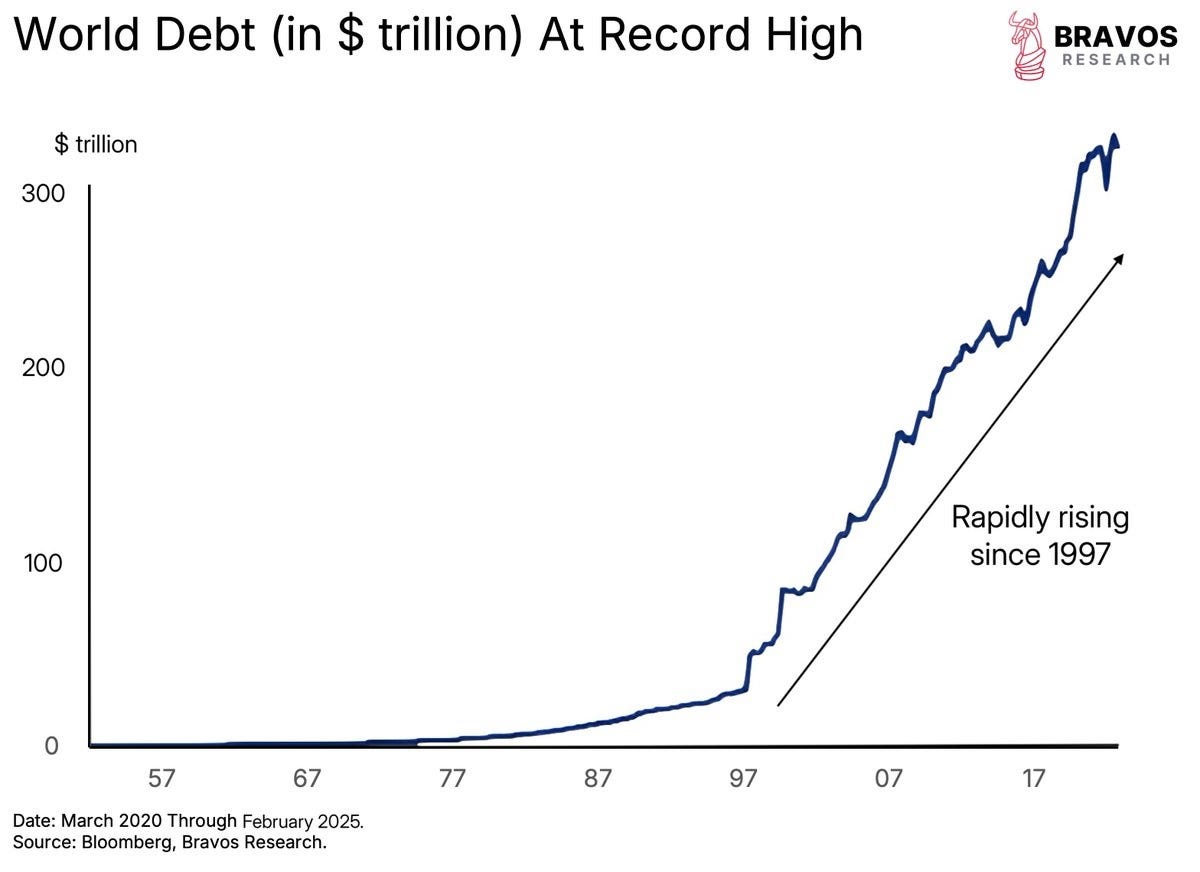

The End of the Fiat Currency Experiment, in Seven Charts

Anyone with a grasp of human nature in 1971 would have understood that giving governments monetary printing presses untethered to anything real would produce a world awash in debt. And that’s exactly what we got:

For a sense of the scale we’re now working with, consider the concept of “trillion”:

A million seconds ago was May 23rd

A billion seconds ago w…