Q2 Gold Miner Earnings Might Liven Up the Summer Doldrums

Are they still leveraged plays on gold?

Analysts used to refer to gold miners as “leveraged plays on the price of gold” because when gold was rising, miner earnings — and usually their share prices — would go up even more.

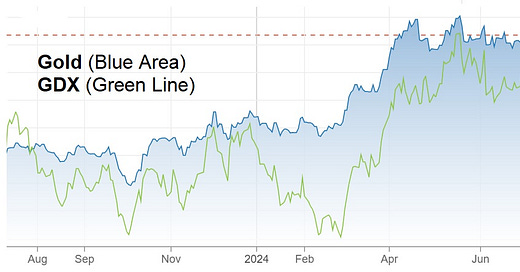

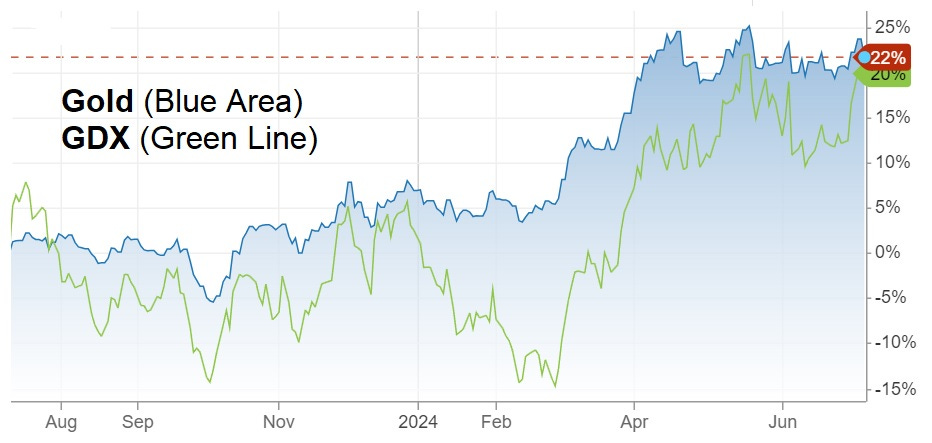

You don’t hear that assertion much anymore because the miners (represented on the following chart by the GDX gold miners ETF) have mostly underperformed the metal in the past year’s bull market.

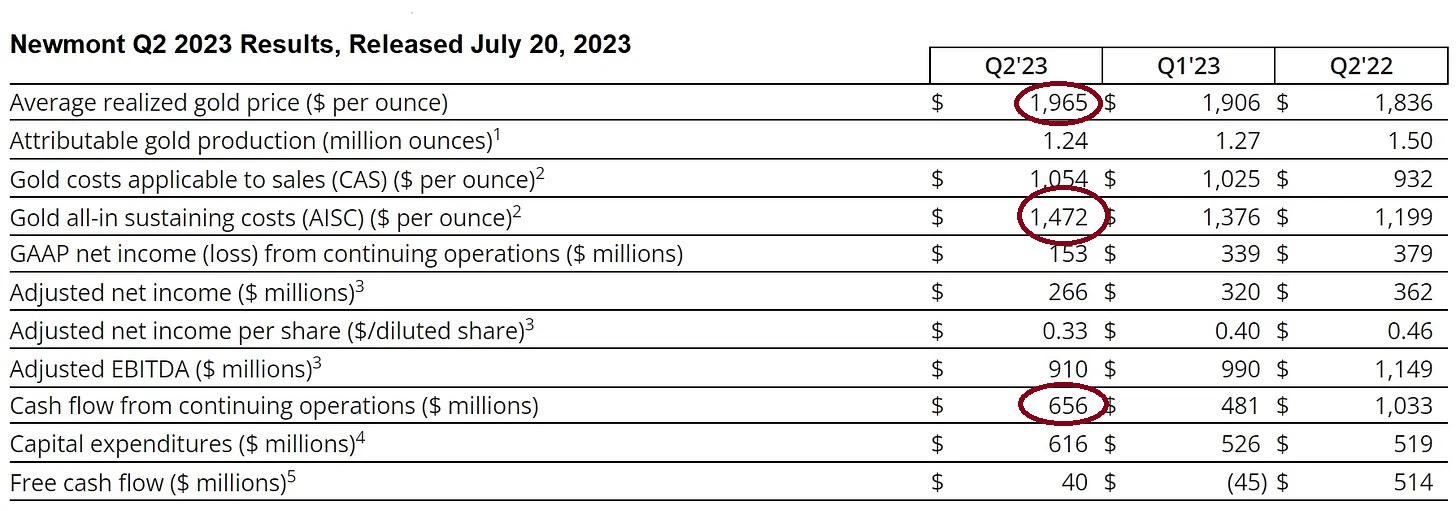

To understand why the miners aren’t behaving better, consider Newmont, the biggest gold producer. The following table is from last year’s second-quarter earnings report.

Notice a few things:

The price of gold rose by 7% from Q2 2022 to Q2 2023.

But all-in-sustaining costs (AISC, the truest measure of a miner’s costs) rose even more, by 23%.

With costs outpacing revenue, cash flow from continuing operations was down significantly year-over-year.

Declining cash flow is bad for a company’s share price, which explains why Newmont and most other mining stocks have underperformed even in the kind of gold price environment where they used to thrive.

Positive Earnings Surprises Coming?

The Q2 earnings season starts shortly, and gold is way up from last year. Let’s round conservatively and say that the average Q2 2024 gold price was $2300/oz, an increase of 17% over Q2 23’s $1965/oz.

For an idea of what that might mean, assume a hypothetical miner that produces 1 million ounces of gold per quarter. An increase of $300/oz times 1 million ounces = $300 million of extra revenue per quarter, or $1.2 billion per year.

If the miner’s costs are stable, all the extra revenue goes right to the bottom line and cash flow soars. If costs are rising, the extra revenues get eaten on the way down and cash flow grows modestly or not at all.

So the question becomes, How much of the miners’ impressive Q2 revenue growth was offset by rising costs? The answer will vary from miner to miner. However, for those who controlled their costs, the extra revenue could produce big percentage gains in earnings and cash flow.

By the way, the story is basically the same for silver, which was up nicely year over year in Q2: