Obviously, we have to start with gold breaking $2200/oz:

In other news…

Bank of Japan scraps radical policy, makes first rate hike in 17 years

(Reuters) - The Bank of Japan (BOJ) ended eight years of negative interest rates and other remnants of its unorthodox policy on Tuesday, making a historic shift away from its focus on reflating growth with decades of massive monetary stimulus.

The shift makes Japan the last central bank to exit negative rates, and ends an era in which policymakers around the world sought to prop up growth through cheap money and unconventional monetary tools.

The central bank also abandoned yield curve control (YCC), a policy in place since 2016 that capped long-term interest rates around zero, and discontinued purchases of risky assets.

NATO Ally Could Command 60,000 Strong Force in Ukraine: General

(Newsweek) - French troops are ready for "the toughest engagements," the commander of the country's ground forces has said, as President Emmanuel Macron mulls an official military deployment to Ukraine despite repeated Russian threats of retaliation.

Macron is at the forefront of a nascent proposal by a handful of NATO nations to discuss sending allied forces into Ukraine in training and advisory roles, though not as combat troops. The Baltic states of Estonia, Lithuania and Latvia, as well as Poland, have expressed support of Paris' position, though large NATO states like the U.S. and Germany are opposed.

Russia won't attack NATO, but F-16s will be shot down in Ukraine, Putin says

(NBC) - Russia has no designs on any NATO country and will not attack Poland, the Baltic states or the Czech Republic, but if the West supplies F-16 fighters to Ukraine then they will be shot down by Russian forces, President Vladimir Putin said late Wednesday.

“We will destroy the aircraft just as we destroy today tanks, armored vehicles and other equipment, including multiple rocket launchers,” said Putin.

Baltimore bridge collapse: US braces for supply chain disruption

(Guardian) - The US transportation secretary, Pete Buttigieg, has warned of “major and protracted impact to supply chains” following the closure of the Port of Baltimore for the forseeable future after Tuesday’s catastrophic bridge collapse, though some experts said the impact was likely to be targeted to particular regions and industries.

Spanning more than 2km and with four lanes of traffic, the Francis Scott Key Bridge – a vital artery in Baltimore’s industrial heartland – took nine years to plan and almost five to build, but came down in under a minute after being struck by a cargo ship in the early hours of Tuesday.

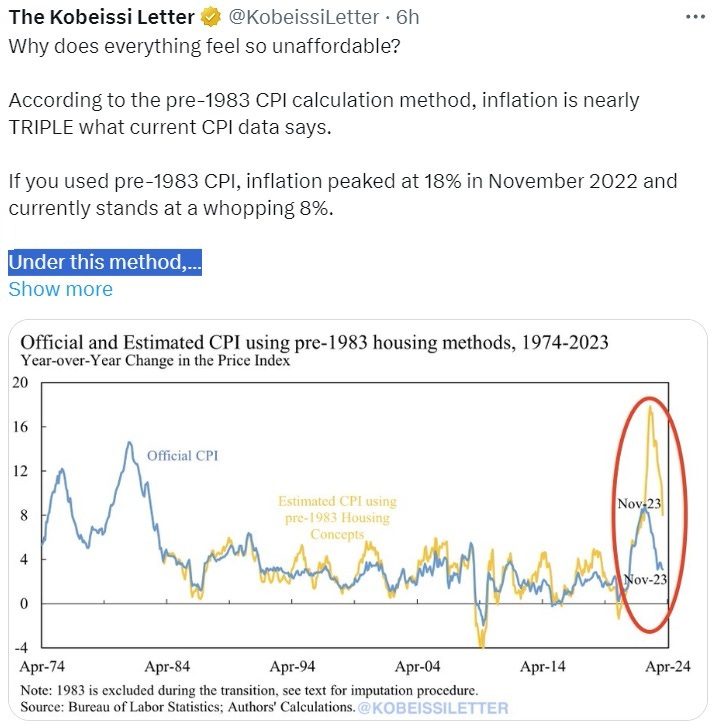

Last but not least, you’re not imagining it: Inflation is actually a lot higher than the government says:

Sector News

Egon von Greyerz: Gold — We have liftoff!

Sprott rolls out Sprott Copper Miners ETF

Central banks go for the gold in January, pointing to a third straight year of strong demand

The AI industry is pushing a nuclear power revival — partly to fuel itself

Thailand And Philippines "Charging Ahead" With Plans To Embrace Nuclear Power

Over 20% of the World’s Oil Refining Capacity Is at Risk of Closure

Why Morgan Stanley Says to Buy Energy Stocks Right Now

In Historic Reversal, US To Restart A Shut Down Nuclear Power Plant For The First Time Ever

China's Top Copper Smelters Agree to Production Cut Amid Raw Material Tightness, Sources Say

Oil Prices Surge as Russia Strikes Ukrainian Energy Facilities