Portfolio Stock Update: When Is A Gold Miner Also A Value Play?

That depends on the metric. Here's an unusual one

Generally, a “value” stock is one that trades at a low ratio of price-to-earnings (P/E) or price-to-book value. But mining stocks aren’t normally analyzed with those traditional metrics because a miner’s value depends less on current earnings than on the amount of metal it has in the ground.

To illustrate the point, picture two gold miners with similar current-year production, profit margins and, as a result, earnings. But one has ten times as much gold in the ground as the other. If the price of gold goes up, both miners’ earnings will rise by the same amount. But the miner with the bigger resource will see its market value rise much more as all those extra ounces are revalued. The result is two very different P/E ratios despite similar earnings.

So miner P/E ratios are all over the place, and are frequently high enough to make “value” claims look laughable.

Can a miner ever be a value play? Sure, but that’s usually expressed in terms of ounces in the ground per share rather than a P/E ratio. There are a lot of very cheap miners based on this metric and one of these days I’ll do a “top five” post listing some interesting examples. But in the meantime …

Profitable miner, low P/E

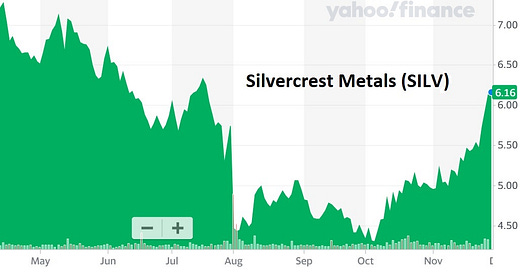

Every once in a while, a miner comes along that’s both successful and cheap by traditional metrics like P/E. Here’s one from our portfolio that’s worth a closer look.