May was a month in which the financial markets focused on the wrong things and drew wildly bone-headed conclusions. Garbage in, garbage out.

The biggest drama was the debt limit “crisis” which — like the 70+ previous times the US has engaged in that particular form of play-acting — was never a real thing. Both sides exempted Social Security, Medicare, and the military from possible cuts and then battled over the pennies that were left in school lunches and food stamps. As this is written on June 1, a deal has been struck and the government debt orgy is about to resume.

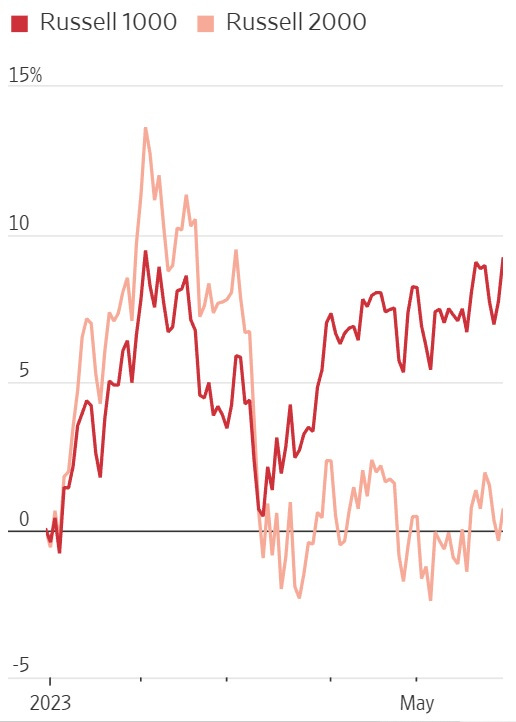

The other meaningless excitement was generated by better-than-expected tech stock earnings, followed by the realization that artificial intelligence (AI) was ready for its hype cycle launch. Big Tech stocks rose, pulling up the broad market indexes (thus brutalizing our NASDAQ short position, see below) while NVIDIA — the chip maker with the hottest AI processors — saw its market cap soar by 30% in a single day, to over $1 trillion. The following chart compares the Russell 1000 index of large-cap stocks to the Russell 2000 smaller-cap stock index. Note the massive and growing divergence in favor of large-cap names.

But it was all fake. Raising the debt ceiling will allow everyone to re-focus on real things like tightening monetary conditions and a slowing economy. Corporate profits decline during recessions and tech is just as vulnerable to such shrinkage as any other sector. So short-selling will have its day in the sun.

Meanwhile, the commodity stocks that suffered for most of the month are getting some relief. The last trading day of May and (so far) the first of June have offered a glimpse of what’s to come when capital starts pouring into real assets.