April is “earnings season,” when most public companies release their Q1 reports. And — in terms of earnings — it was a good month for our portfolio. Precious metals streamers and oil companies put up generally strong numbers, in part thanks to higher prices for what they’re selling and in part because they’re the cream of their respective crops and have made some good operational decisions.

Uranium miners continued to enjoy good macro news, which should reach their top and bottom lines — and their stock prices — eventually. And precious metals explorers’ drill results ranged from good to great.

The financial markets couldn’t decide if central bank tightening was near its end or likely to continue into this year’s second half. So stocks meandered, neither soaring nor — as feared — crashing. Watch the ECB and US Fed this week for clues about which way this indecision is going to break.

Other than that, it was a mess out there, as signs of a broader slowdown multiplied:

Q1 GDP growth fell to 1.1%.

Banks continued to tighten lending standards.

Pending home sales fell for the first time since November.

Layoffs spread from Silicon Valley through the broader economy.

Another major bank — First Republic — was bailed out by the FDIC and then subsumed by JP Morgan Chase. Everyone now wonders “Who’s next?”

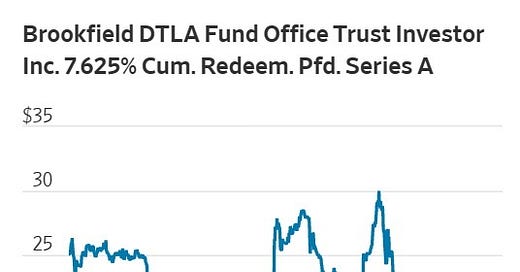

Commercial real estate continued its descent into a cyclical abyss, as office vacancy rates rose and building sale prices fell. Some related securities traded like it was 2009: