November was yet another good news/bad news month for precious metals. Gold and silver were hit with post-election relief selling (maybe we’re not stumbling into World War 3!). But gold partially recovered to finish the month on a strong note:

The gold miner shares, however, took a hit along with gold and as a group have yet to fully recover. This kind of gold bull market should be rocket fuel for the mining shares, but so far that’s not happening.

But there’s light at the end of this tunnel. A higher gold price is finally starting to produce wider profit margins for well-run miners (see here and here), who are now earning a record amount on each ounce of gold produced. On the following chart, AISC stands for “all-in sustaining costs,” the broadest measure of miner expenses. With gold at $2600, $881 of that is now profit.

And more good earnings reports are coming. We’re now two-thirds of the way through the fourth quarter, with the current gold price higher than the Q3 average price. This means Q4 earnings that are announced in early 2025 might feature both year-over-year and sequential growth. At some point, the resulting cash flow ought to have the desired effect on miners’ share prices.

The only unambiguous commodities winner in November was uranium. A growing number of countries are beginning aggressive nuclear power build-outs, and uranium miners are reporting strong earnings and positive exploration results. Here’s how that impacted industry leader Cameco:

Macro and Sector News

Russia imposes temporary ban on export of precious metals waste, scrap

US Unveils Plan to Triple Nuclear Power by 2050 as Demand Soars

Texas proposes gold and silver-backed currencies to compete with fiat money

Palisades nuclear plant along Lake Michigan plans for a 2025 comeback, a 1st in the U.S.

Trump Chooses Oil Fracking Boss Wright as Energy Secretary

Delay in Chile mining permits a serious problem, says local head of Freeport

Oil Glut Set to Thwart Trump’s Call to ‘Frack, Frack, Frack’

The Biggest Crypto Bluff Ever Made

Is the United States Considering a Gold-Backed Treasury Instrument?

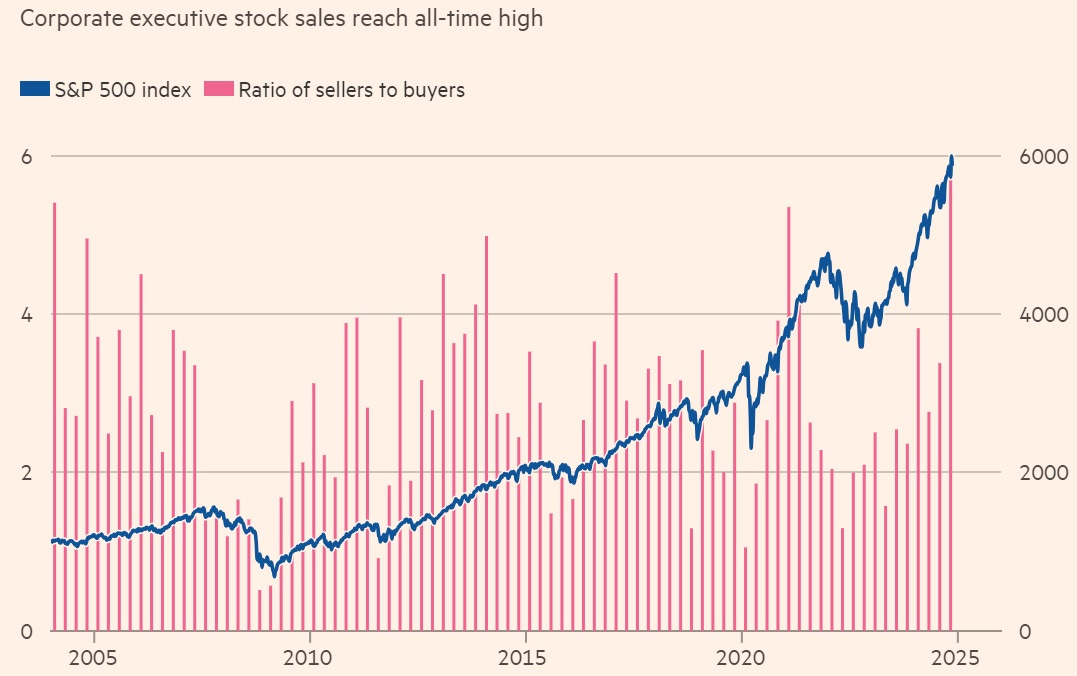

Last but not least, insiders are selling shares in their companies — hard. What do they know that other investors don’t?