Monthly Note And Portfolio Review February 2023

First the bad news, then the good

Hi everyone,

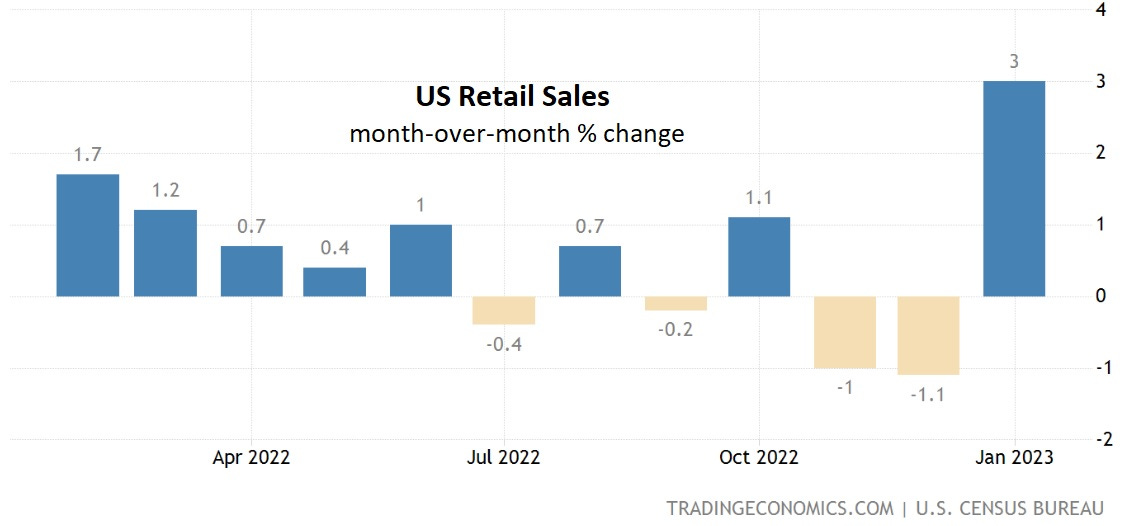

So much for that “imminent” recession. February was supposed to be the month when layoffs accelerated, consumers stopped spending, and the economy stopped growing (thus allowing the Fed to stop tightening). Instead, several economic reports came in stronger than expected. US retail sales popped:

The US unemployment rate fell:

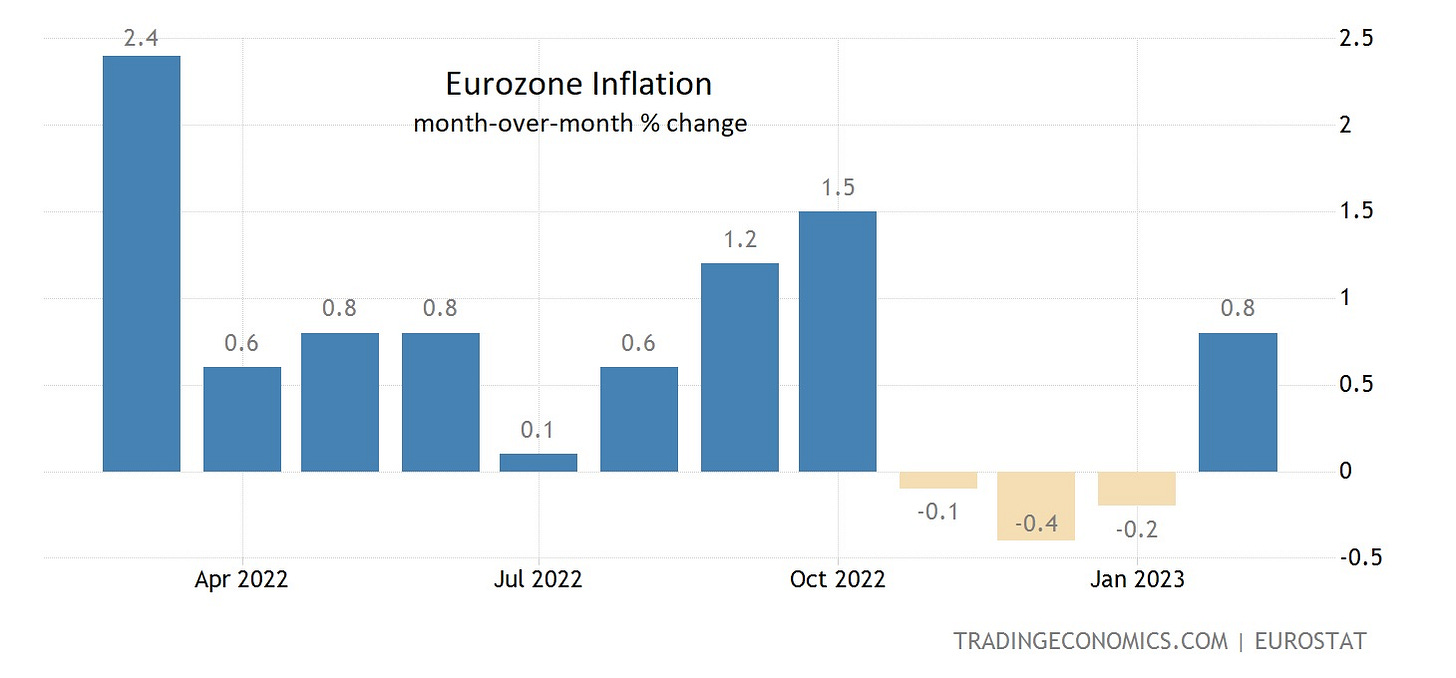

And Eurozone inflation, after three months in negative territory, jumped to an unacceptably high level:

These hints of robust, inflationary growth have put central banks in a tough spot. They really want to stop tightening, but can’t until jobs and inflation roll over. So we should expect several more 0.25% (or maybe 0.5%) increases in upcoming Fed meetings.

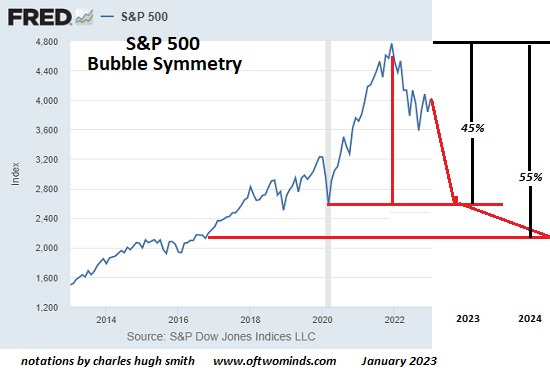

The result? Monetary conditions, already tight, will get even tighter until something breaks on Main Street and/or Wall Street. Put another way, this is not a great time to build a portfolio of precious metals and energy stocks, but it might be an excellent time to short pretty much anything. Here’s a chart from Charles Hugh Smith (soon to be profiled in this newsletter) illustrating the typical symmetry of financial bubbles. They soar, and then they give it all back when the bubble bursts. It’s dangerous to stand in the way of this kind of capitulation.

On that cautionary note, let’s see how our starter portfolio did in February.