Back in the late 1990s, a mining engineer named Rudi Fronk noticed that the big gold miners were terrible capital allocators. They overpaid for properties at cyclical peaks and sold off their non-core assets for pennies on the dollar during subsequent recessions.

So Fronk and his partners took over a shell company called Seabridge Resources, with the goal of snapping up some of those bargains. In June of 2000 — with gold trading at around $280/oz — Seabridge paid $200,000 for KSM, a British Columbia gold/copper property on which Placer Dome had spent $25 million. KSM at the time contained a massive 3.4 million ounces of gold and 2.7 billion pounds of copper.

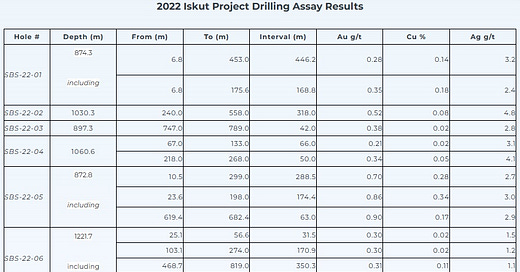

Over the ensuing two decades, Seabridge has been buying up other similar properties and exploring them to increase the number of ounces in the ground. Below is a representative batch of drill results. Note the multiple 100+ gram-meter gold intercepts and the consistent presence of copper and silver. Despite the low grades, there’s a lot of metal here.