This mid-tier royalty/streamer has been an enigma for the past couple of years. Where most such companies tend to grow steadily by cutting modest deals for new incremental revenue, this one baked in a half-decade of growth with one big acquisition.

Meanwhile, with gold around $2500/oz, the company’s gross profit per ounce is around $2000. With margins like that, it’s hard not to make serious money.

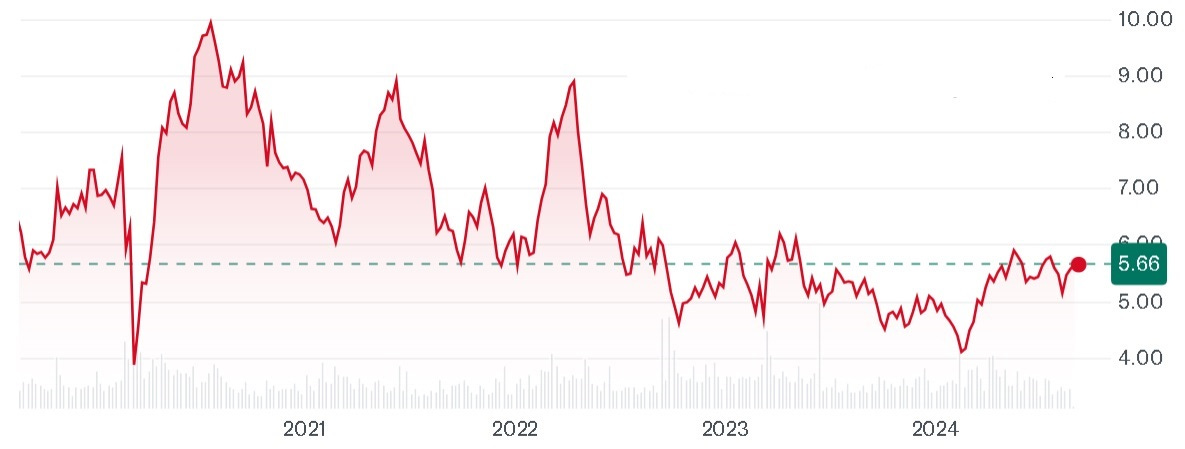

So far, so good. But now comes the tricky part: The cost of those highly profitable future ounces was an intimidating amount of debt, with all the resulting interest expense and financial risk that that implies. This financial uncertainty has caused investors to shy away from what would otherwise be an interesting growth play. Its stock, as a result, has languished while the price of gold has risen.

So who is it and what’s the prognosis?