There’s a business practice sometimes called “vendor financing” in which a company lends money to a customer, who then uses that money to buy the company’s products. The company reports the proceeds as sales and income, usually without a full accounting to its shareholders.

This financing scheme can work — as long as the customer pays back its debts. But if the customer defaults, the company is stuck with a non-performing asset, leading to write-downs that can wipe out prior sales and earnings.

Why do we care about this arcane, borderline-sleazy business practice? Because it’s taking over the world of AI, which is currently supporting the entire US financial system. Two examples:

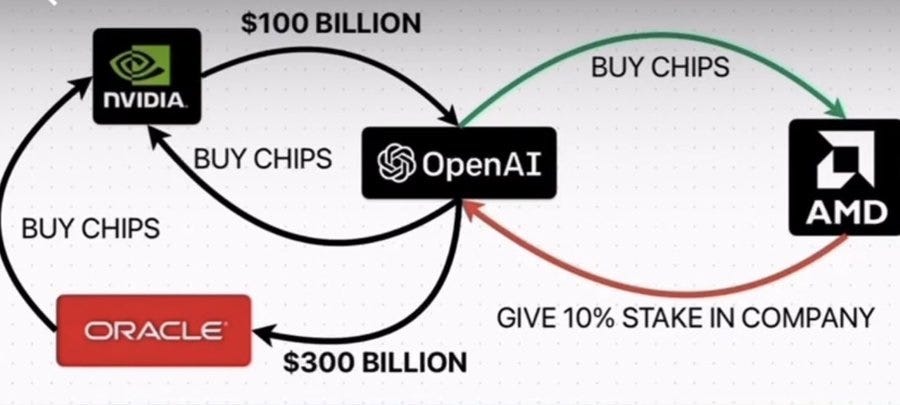

Chip maker Nvidia invests $100 billion in AI leader (and supposed non-profit) OpenAI. OpenAI uses that money to build more AI data centers, which run on Nvidia chips.

Chip maker Advanced Micro Devices (AMD) gives OpenAI 10% of its stock in return for a promise to use AMD chips in future AI data centers. Investors pour into AMD stock on the news, raising its market cap by more than the cost of the stock it sold.

This story continues through numerous other deals worth hundreds of billions of potentially illusory sales and market cap. Here’s a graphic depicting some recent action…

…and two simpler views of the concept:

For a deeper dive, see the following:

As per Karl Denninger - Seriously folks, the OpenAI "investment" into AMD is arguably the most-ridiculous example of this I've ever seen.

OpenAI has never made a single nickel in net profit. Not one. They are, thus far, nothing more than a circular money-funneling machine taking "investments" from various places and spending it -- or worse, committing to do so at a scale they cannot actually fund in the present tense.......

Full text:

https://market-ticker.org/akcs-www?post=254178

.....Without power an electrically-operated thing is a worthless brick.

As an example the capital cost for a 1GW nuclear plant in the United States is currently estimated to run in the neighborhood of $10 billion cash. This in turn means that if you're going to build "5 GW" of data center you need to add to the capital expense another $50 billion and that does not include the operating cost, just the construction and presumes you can fund it with cash and do not have to pay interest on the money.

To be able to build that of course you need the revenue and I've seen projections that $2 trillion in revenue would be a reasonable expectation to fund these projects on the board not including the capital cost of the power required for them since nobody is adding that in. This is some 20 times the current revenue of all AI products combined and roughly 7% of US GDP with all of it spent "on the come" without meaningful contribution to the bottom line.

If you actually believe any of this and are "investing" based on it you deserve to lose every penny you put in -- and further, no firm should be able to claim to be planning to install gigawatt draws on the power grid without also including the capital cost and time to deliver said power generation and transmission within their projections and at their expense.

To do so should be considered securities fraud.

I remember the dot com bust- there are many parallels between the sitcom mania and the current AI mania- massive amount of capital in with small increments of positive ROI. Out of balance see what happens going forward