Collapse Life just posted an article on house hunting that anyone who’s in that market will relate to. Basically, this is what inflation does to our idea of an acceptable home — and to our understanding of basic terms like “luxury,” “cozy,” and “affordable.”

The end of truth comes with luxury vinyl plank flooring

What real estate listings reveal about our cultural addiction to hype, delusion, and the slow rot under the surface.

(Collapse Life) - For the last several months, the Collapse Life team has been engaged in the noble, ancient ritual known as ‘the house hunt,’ in which one trades sanity, savings, and sometimes a right arm for the dream of shelter.

The search has been broad and exhausting, to say the least, because house hunting in 2025 feels more like hunting for a wild animal.

Allow us to set the scene: you start out cloaked in a camouflage of dejection bordering on disinterest, in order to thoughtfully shield your budget and enthusiasm from the prying inquiries of a selling agent. Armed with Google StreetView and some finely-tuned Zillow alerts, you scan the horizon and zero in with laser precision on the elusive, yet majestic, beast known as Habitable Dwelling Within Budget.

The fact that nearly 50 million other Americans are chasing the same dream offers little comfort. Regardless, a seasoned hunter never worries about the competition; years of experience tangling with skilled adversaries means saccharine hyperbole and quaint euphemisms don’t faze you in the least. You see these traps miles away.

Right?

Here’s an example of what one of those decoys might look like. This was an actual listing the Collapse Life team read just the other day:

“This property is an outstanding choice for anyone looking for a luxuriously remodeled home at a great price. This home features like-new appliances, a stainless steel refrigerator, a large front and back yard, washer and dryer hookups, beautiful vinyl plank flooring, and carpet in the bedrooms! This home will not last long!”

But there’s a problem. The photos and reality don’t compute. The “remodeled” home is a beige box of despair, replete with a sagging porch and moldy ceilings. Even before engaging the necessary olfactory glands so useful to the hunt, it’s obvious the bedroom carpets will reek of stale cigarettes and cat pee. Yes, the “like-new” fridge is stainless steel, but it is far from unstained.

Our home search has laid bare something disturbing: we live in a society where truth itself has been given a “luxury remodel.” Slapping down the cheapest vinyl plank flooring from Home Depot does not transform a slum into a palace. Wiping greasy fingerprints off an appliance does not make it “like new.” The words “this home won’t last!” shouldn’t trigger a warning about the structural integrity of the foundation.

Somehow, though — probably thanks to the unholy trinity of HGTV, Instagram, and Airbnb — we’ve normalized such absurdity. It doesn’t help that photography and insane photo filters have created deceptive illusions. Coerced into purchasing an electric toothbrush from Amazon that’s not quite what you expected? Return it, no problem. Try doing that with a home.

It has become stark irony — at least to Collapse Life — that deceitful words and slick pictures are the price of admission to partake in this unhinged housing market. To be seen and heard, and to stay ‘competitive,’ a seller must subscribe to, and be an active participant in, ritualistic deceit.

Honesty is now a quaint anachronism. Duplicity is the new default currency.

Naturally, this doesn’t just apply to real estate — it’s everything from resumés, job descriptions, social media captions, political speeches, product packaging, venture capital pitches… truth has been replaced by Chat GPT’d artifice. A NerdWallet survey earlier this year found that nearly 7 in 10 Americans believe the housing market has never been worse for buyers, and it’s little wonder why. The game is totally rigged.

Believe it or not, the following would be a refreshing home listing to read:

“Look, it’s four walls and a roof over your head — mostly. The foundation has issues, but so does your credit score. There’s mold in the bathroom and the roof probably won’t survive another winter. The backyard gets good sun, which the fire ants seem to enjoy. The neighbors are loud, and we’ve been thinking an 8-foot privacy fence could help, but we just never got around to putting it in. Let’s be honest, this wasn’t our forever home and it’s not going to be yours either. But no, we’re not taking your low-ball offer. Thanks for looking.”

This kind of radical honesty could do more to stabilize the housing market than anything the Fed could dream up. If sellers were this upfront, buyers might respond with something revolutionary: a deal that works for both sides, negotiated honorably via empathy and real human connection.

Instead, HGTV-wannabe sales agents keep staging empty homes with rented furniture (or worse, virtual reality furniture), deceptive lighting, and fisheye lenses, hoping no one notices the cracks — both literal and figurative. To say nothing of the subtle “touch-ups” the IT guy or an AI assistant can do.

If collapse is coming, it won’t just be triggered by conflict or de-dollarization or the death of fiat currencies. It may come from something far more banal: our collective inability to tell each other the truth, even about the small stuff… like the luxury of vinyl plank flooring.

Housing Shrinkflation

Commerce of any kind involves favorable spin, of course. And real estate has always been a prime example of the near-perversion of common words.

But now it’s worse than ever, as depreciating currencies push the price of life’s necessities — including the family home — beyond the reach of more and more people, forcing buyers to settle for situations their parents would never have considered.

Think of it as housing’s version of “shrinkflation”.

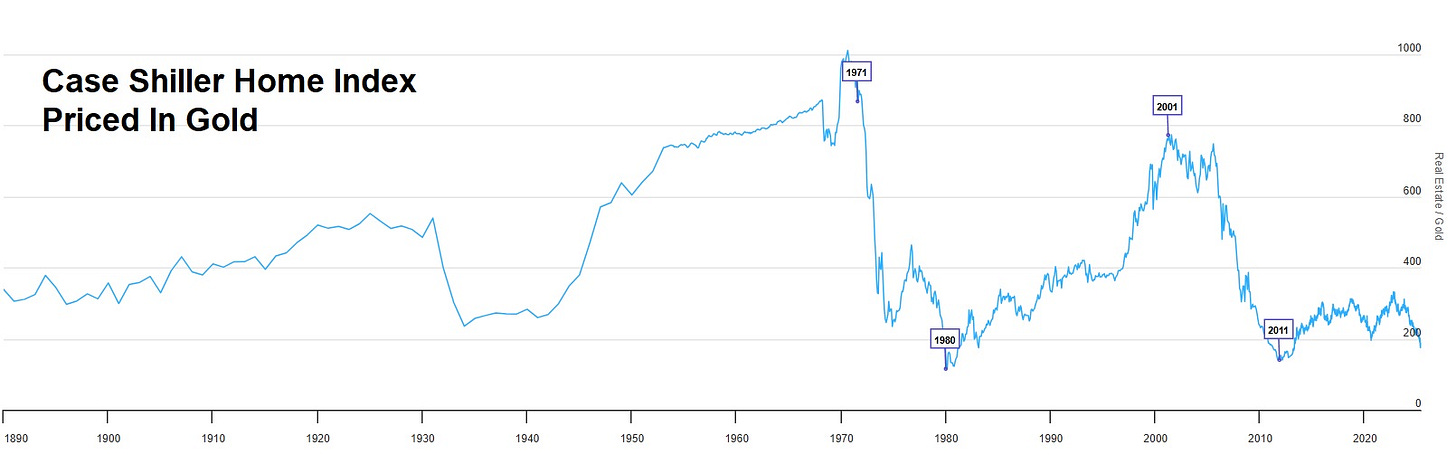

And note that when priced in gold, house prices have been stable during the current bubble. That’s how sound money keeps everyone honest.

Read more from Collapse Life here.

Very reminiscent of a lot of the posting that Charles Hugh Smith has been doing for the last several years. Check him out. All a result of the "stealth" inflation that has gone "unmeasured" by the fedgov's and fedres' phony price measurements for the last 40 years. One perfect example of the insanity (lunacy?) of fed "thinking" - deleting food and energy from the price indices because of their "volatility". Obviously (to anyone with half a brain) if time volatility is a statistical problem you use rolling averages to "smooth" the factor. It's things like this that lead me to the conclusion that there really is no hope left at this point (and the farce with Patel and Bongino trying to tell Maria Bartiromo that "Epstein definitely committed suicide - yep he shore did") doesn't help either. That's a REALLY BAD SIGN. As I've said - BUCKLE UP.....

“Basically, this is what inflation does to our idea of an acceptable home.”

Milton Friedman may say ‘inflation is always and everywhere a monetary phenomenon,” but that statement is deceptive because it doesn’t go far enough. It makes “inflation” sound like it’s just an academic term for ‘price increases’ (or the symptom of monetary expansion), instead of the cause of civilizational breakdown. This piece illustrates just one facet of many occurring throughout society today.

J. M. Keynes said it more bluntly, “There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million can diagnose.”

Hence the confusion.

To many - if not the vast majority - there is a laundry list of competing root causes of societies ills, but if Karl Marx and all the subsequent anti-capitalists and psychopathic subversives are right, unsound money is it.

Understandably, that’s not obvious, at least to me. But it seems now that many people are starting to understand that or at least sense it, hence the rise of the Bitcoin narrative and growing calls to end the Fed/central banking.

But what’s unfortunate is that not everyone is adversely effected by currency devaluation, in fact some actually benefit monetarily.

Keynes again: “By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.”

One could argue that ‘an important part the wealth of citizens’ is spiritual and moral, not just material, and so even those who are enriched monetarily are still impoverished in other ways, hence the intellectual dishonesty and willful ignorance of many of the very wealthy, and most in power.

Given that Keynes is the godfather of modern day central banking, have the Fed’s board members never read him?