It’s another great day for gold, with $2,800 in the rearview mirror and $3,000 in traders’ crosshairs.

This means it’s time to take a deep breath and consider gold’s — and the miners’ —near-term prospects.

Reasons for Caution

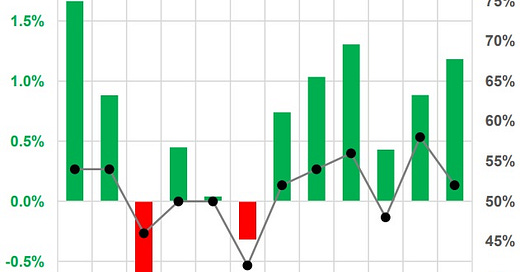

Let’s start with seasonality. Winter is usually a good time for gold, while spring and early summer tend to be boring and/or scary…